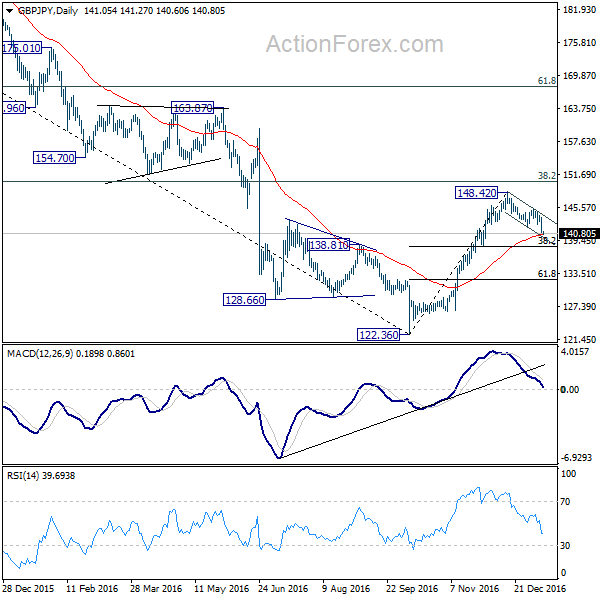

Daily Pivots: (S1) 140.18; (P) 142.01; (R1) 142.99; More…

GBP/JPY’s fall from 148.42 resumed by taking out 142.16 and reaches as low as 140.60 so far. The development confirms short term topping at 148.42 too. Intraday bias is back on the downside for 38.2% retracement of 122.36 to 148.42 at 138.46. As note before, rise from 122.36 is seen as a corrective move. Sustained trading below 138.46 and downside acceleration will indicate that such correction is finished too. And in that case, deeper fall should be seen to 61.8% retracement at 132.31 and below. On the upside, break of 145.38 resistance is needed to confirm completion of the fall from 148.42. Otherwise, near term outlook stays bearish in case of recovery.

In the bigger picture, the down trend from 195.86 top (2015 high) should have made a medium term bottom at 122.36 after hitting 100% projection of 195.86 to 154.70 from 163.87 at 122.71. Price actions from there are expected to develop into a medium term corrective pattern. Upside should be limited by 38.2% retracement of 195.86 to 122.36 at 150.4 for setting the medium term range.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box