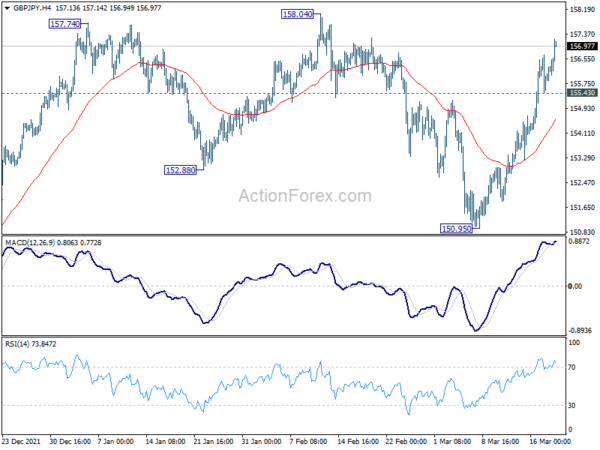

GBP/JPY’s strong rebound from 150.95 accelerated further higher last week. The development suggests that corrective pattern from 158.19 has completed with three waves to 150.95 already. Initial bias remains on the upside this week for 158.04/19 resistance. Decisive break there will resume larger up trend. On the downside, below 155.43 minor support will delay the bullish case and turn intraday bias neutral first.

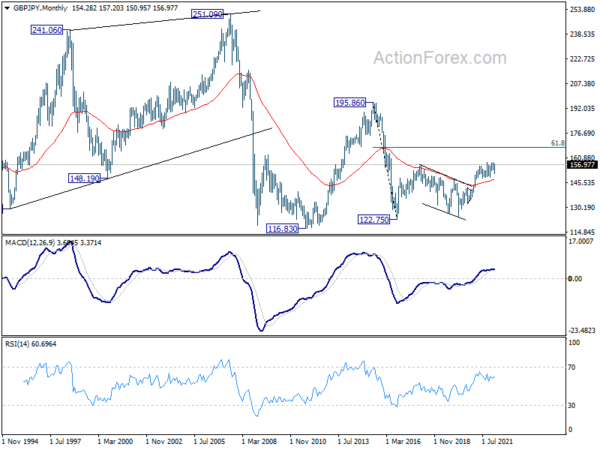

In the bigger picture, up trend from 123.94 (2020 low) should still be in progress, and notable support from 5 week EMA affirms medium term bullishness. Next target is 61.8% retracement of 195.86 to 122.75 at 167.93. This will now remain the favored case as long as 148.94 support holds.

In the longer term picture, as long as 55 month EMA (now at 147.27) holds, we’d still favor more rally to 61.8% retracement of 195.86 to 122.75 at 167.93. But sustained trading below 55 month EMA will at least neutralize medium term bullishness and re-open the chance of revisiting 122.75 low (2016 low).