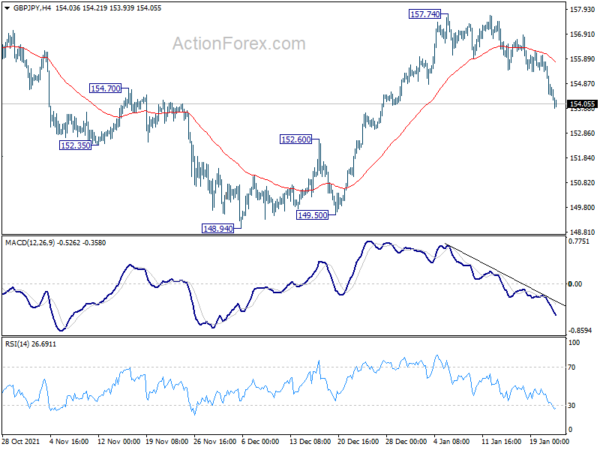

GBP/JPY’s sharp decline last week suggests that rise from 148.94 has completed at 157.74, ahead of 158.19 high. Fall from 157.74 is seen as the third leg of the consolidative pattern from 158.19. Initial bias stays on the downside this week. Sustained break of 55 day EMA (now at 154.13) will target 148.94 support next. For now, risk will stay on the downside as long as 157.74 resistance holds, in case of recovery.

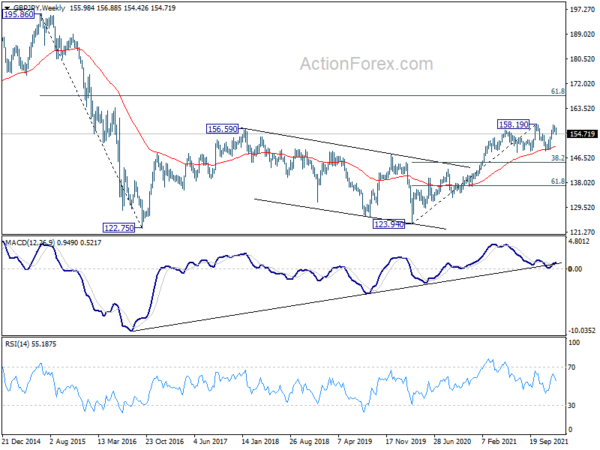

In the bigger picture, price actions from 158.19 are currently seen as developing into a consolidation pattern to up trend from 123.94 (2020 low). Downside should be contained by 123.94 to 158.19 at 145.10 to bring rebound. Firm break of 158.19 will resume the up trend to long term fibonacci level at 167.93. However, sustained break of 145.10 will raise the chance of trend reversal and target 61.8% retracement at 137.02.

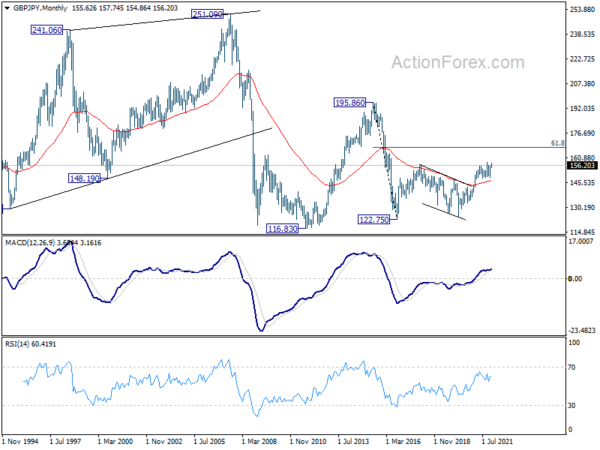

In the longer term picture, as long as 55 month EMA (now at 147.03) holds, we’d still favor more rally to 61.8% retracement of 195.86 to 122.75 at 167.93. But sustained trading below 55 month EMA will at least neutralize medium term bullishness and re-open the chance of revisiting 122.75 low (2016 low).