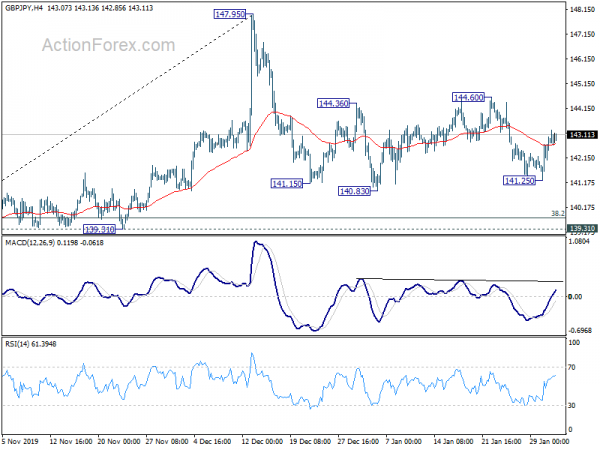

GBP/JPY dropped to 141.25 but recovered ahead of 140.83. Initial bias remains neutral this week as range trading might continue. Further decline remains in favor as long as 144.60 resistance holds. Below 141.25 will target 38.2% retracement of 126.54 to 147.95 at 139.77. However, firm break of 144.60 will bring retest of 147.95 high.

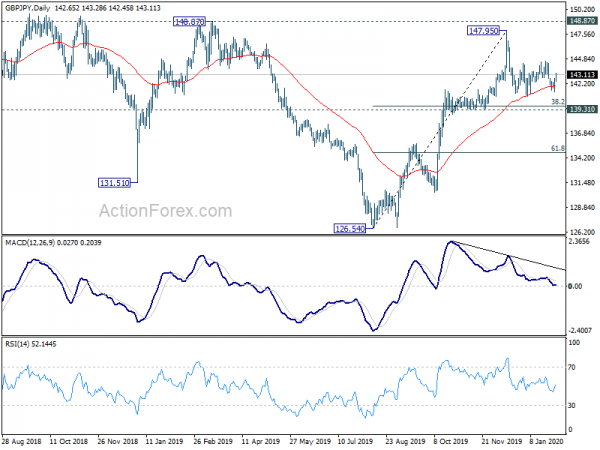

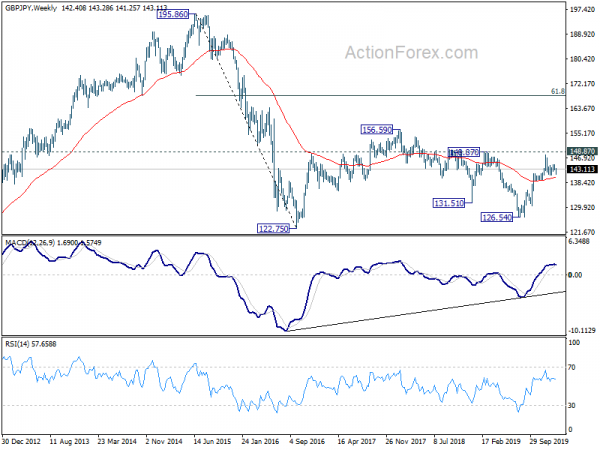

In the bigger picture, rise from 126.54 could either be the third leg of the consolidation pattern from 122.75 (2016 low), or the start of a new up trend. In either case, further rally is expected as long as 139.31 support holds, into 148.87/156.59 resistance zone. Reaction from there should reveal which case it should be in. However, sustained break of 139.31 support will dampen this case and turn medium term outlook neutral first.

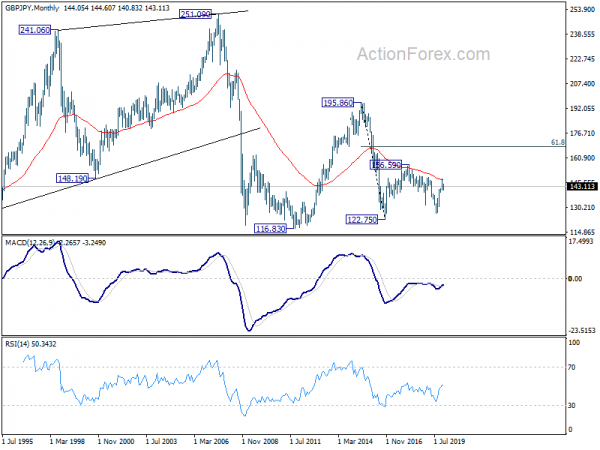

In the longer term picture, in spite of the current strong rally, there is no confirmation of long term bullish reversal yet. Focus is now on 156.59 key resistance. As long as it holds, another decline through 122.75 could still be seen. But firm break of 156.69 should at least bring further rally to 61.8% retracement of 195.86 to 122.75 at 167.93.