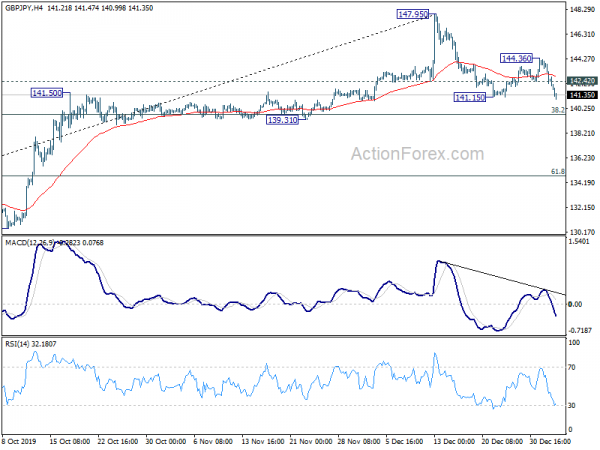

Daily Pivots: (S1) 141.86; (P) 143.02; (R1) 143.76; More…

GBP/JPY’;s break of 142.42 minor support suggests that corrective fall from 147.95 is resuming. Intraday bias is back on the downside for 38.2% retracement of 126.54 to 147.95 at 139.77. At this point, we’d expect strong support from 139.31/77 to bring rebound. But in any case, risk will stay on the downside as long as 144.36 resistance holds, in case of recovery. Sustained break of 139.77 will pave the way to 61.8% retracement at 134.71.

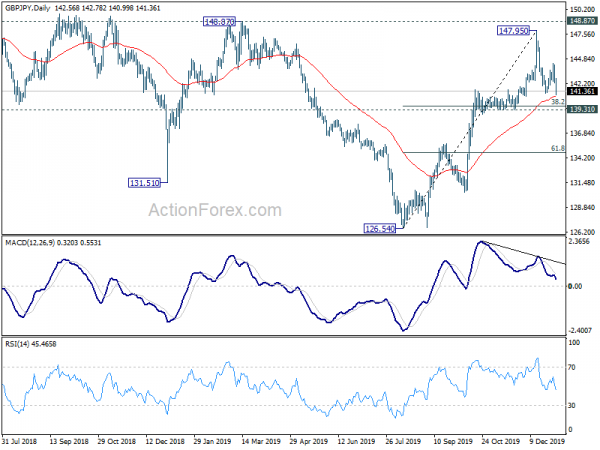

In the bigger picture, rise from 126.54 could either be the third leg of the consolidation pattern from 122.75 (2016 low), or the start of a new up trend. In either case, further rally is expected as long as 139.31 support holds, into 148.87/156.59 resistance zone. Reaction from there should reveal which case it should be in. Rejection from there will extend long term range trading. Decisive break of 156.69 will carry long term bullish implications.