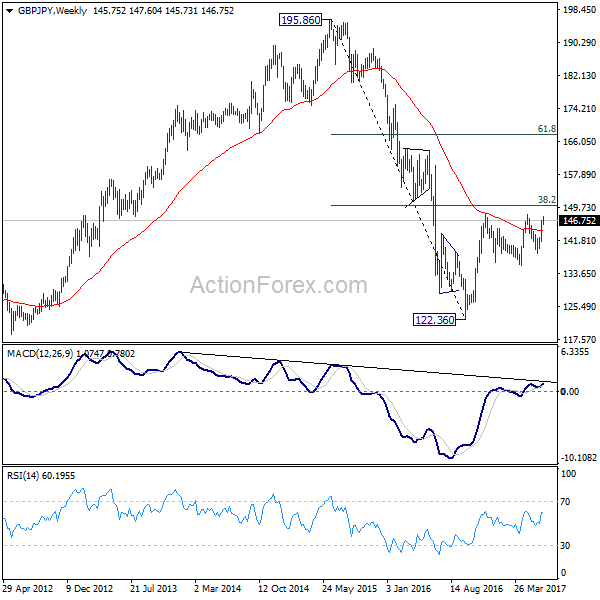

GBP/JPY edged higher to 147.06 last week as rise from 138.65 extended. But upside momentum has been rather unconvincing with 4 hour MACD staying below signal line. Further rise is mildly in favor this week for 148.09/42 resistance zone. Decisive break there will extend whole rally from 122.36 to long term fibonacci level at 150.43 next. Nonetheless, break of 146.03 minor support will indicate short term topping. In such case, bias will be turned back to the downside for pull back towards 55 day EMA (now at 143.02).

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we’d be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.

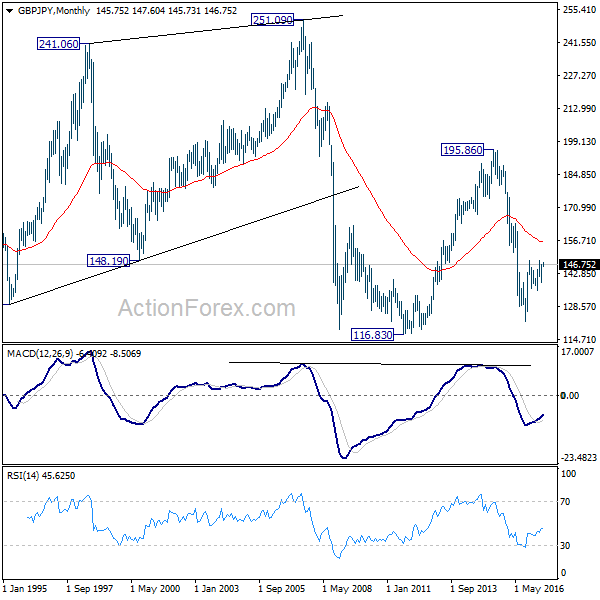

In the longer term picture, it remains to be confirmed is whole down trend from 195.86 has completed at 122.36 already and there is no confirmation yet. But in any case, firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 would pave the way to 61.8% retracement at 167.78. And with that, the 55 month EMA will be firmly taken out which suggests that price actions from 116.83 is indeed a sideway pattern that could last more than a decade.