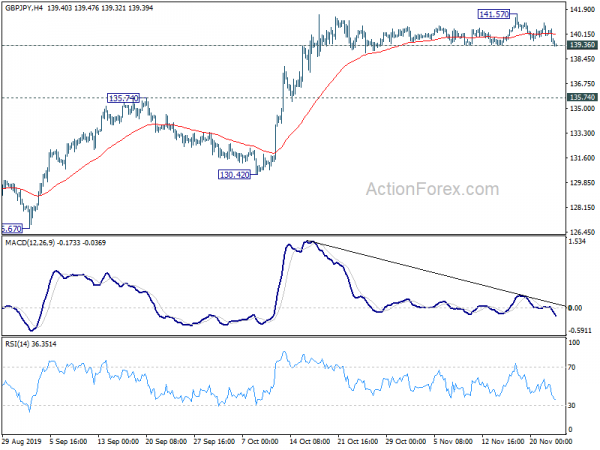

GBP/JPY edged higher to 141.57 last week but failed to sustain above 141.50 and retreat sharply. Initial focus is on 139.36 minor support. Break there will indicate short term topping. Deeper fall should then be seen back to 135.74 resistance turned support first. On the upside, break of 141.57 will resume the rise from 126.54 to for 148.87 key resistance.

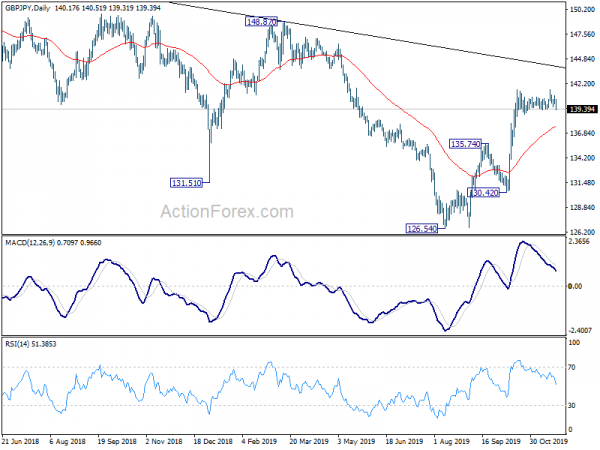

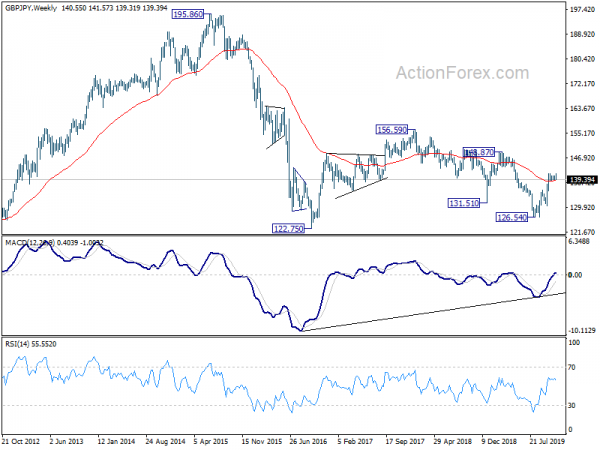

In the bigger picture, consolidation pattern from 122.75 (2016 low) is still in progress with rise from 126.54 as the third leg. Further rise should be seen back to 148.87/156.59 resistance zone. For now, we’d expect strong resistance from there to limit upside. On the downside, sustained break of 135.74 will suggest that such rebound has completed. Deeper decline could the be seen to retest 126.54 low.

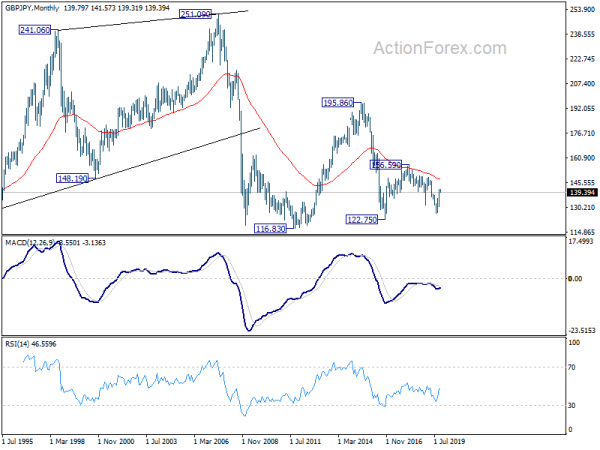

In the longer term picture, price actions from 122.75 (2016 low) are seen as developing into a consolidation pattern. That is, long term down trend from 195.86 (2015 high) and that from 251.09 (2007 high) are still in favor to extend through 116.83 (2011 low). We’ll hold on to this bearish view as long as 156.59 key resistance holds.