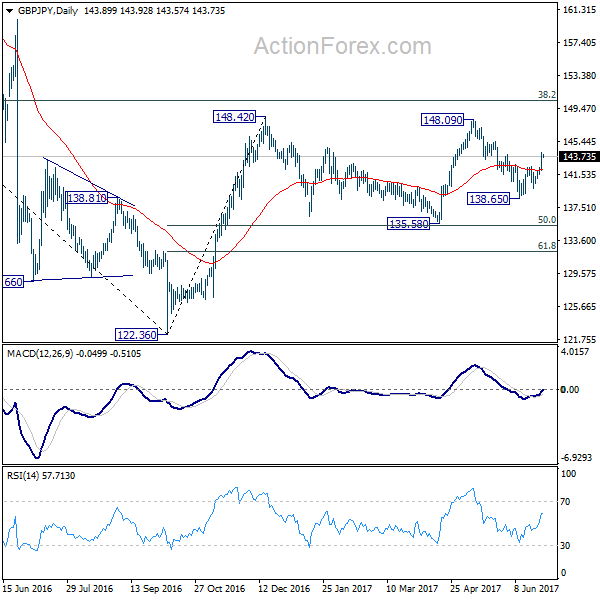

Daily Pivots: (S1) 142.53; (P) 143.36; (R1) 144.78; More….

GBP/JPY’s rally and break of 142.75 resistance indicates completion of fall from 148.09. Intraday bias is turned back to the upside for 148.09/42 resistance zone. Decisive break there will resume whole rebound from 122.36. On the downside, below 141.95 minor support will turn intraday bias back to the downside for 138.65 support instead.

In the bigger picture, while the fall from 148.09 is deeper than expected, we’re not bearish in the cross yet. Price action from 148.42 is possibly developing into a sideway pattern with fall from 148.09 as the third leg. Deeper decline could be seen but we’re looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Rise from 122.36 is still mildly in favor to resume at a later stage. Decisive break of 38.2% retracement of 196.85 to 122.36 at 150.43 will pave the way to 61.8% retracement at 167.78.