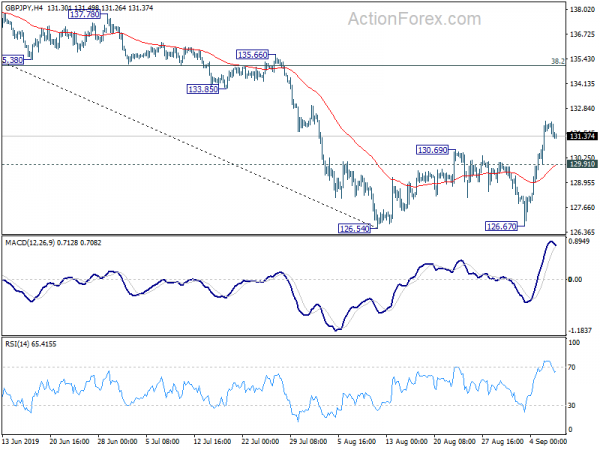

GBP/JPY’s corrective rise from 126.54 resumed last week by breaking 130.69 resistance. Initial bias stays on the upside this week for 38.2% retracement of 148.87 to 126.54 at 135.07. We’d expect strong resistance from there to limit upside to bring down trend resumption. On the downside, below 129.91 minor support will turn bias back to the downside for retesting 126.54.

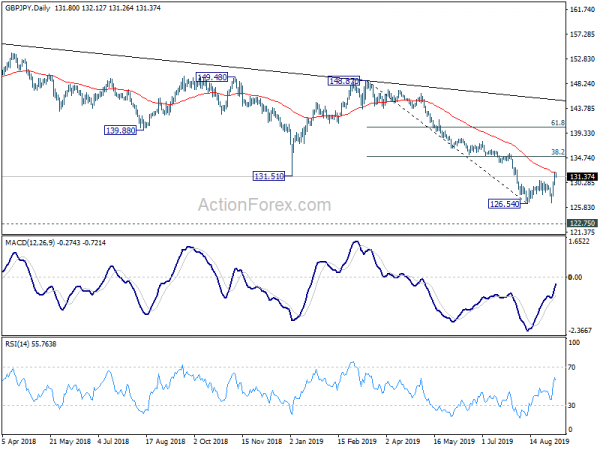

In the bigger picture, outlook remains clearly bearish with GBP/JPY staying well below 55 week and 55 month EMA. Medium term fall from 156.59 (2018 high) is still in progress. Next target is 122.75 (2016 low). We’d be cautious on bottoming there. But break of 135.66 resistance is needed to be the first sign of reversal. Sustained break of 122.36 will target next key level at 116.83 (2011 low).

In the longer term picture, for now, we’re treating price actions from 122.36 as a corrective pattern. Hence, strong support could be seen at 122.36 to bring rebound before the pattern completes. However, sustained break will raise the chance of resuming long term down trend from 251.09 (2007 high). Next downside target will be 61.8% projection of 195.86 to 122.36 from 156.59 at 111.16.