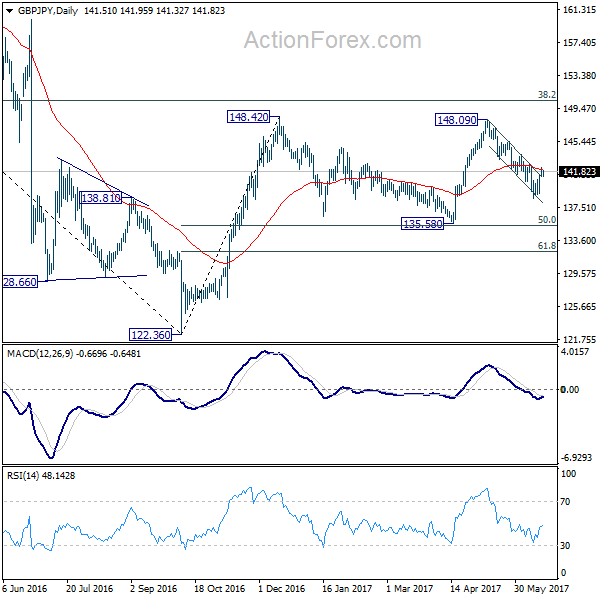

Daily Pivots: (S1) 141.17; (P) 141.75; (R1) 142.19; More….

Intraday bias in GBP/JPY remains neutral first. The break of near term falling channel suggests reversal but we’re prefer to see break of 142.75 resistance to confirm. In that case, intraday bias will be turned to the upside for 148.09 resistance. On the downside, break of 138.65 will resume the decline from 148.09. But in that case, we’d look for bottoming signal around 135.58, which is close to 135.39 fibonacci level, to bring rebound.

In the bigger picture, while the fall from 148.09 is deeper than expected, we’re not bearish in the cross yet. Price action from 148.42 is possibly developing into a sideway pattern with fall from 148.09 as the third leg. Deeper decline could be seen but we’re looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Rise from 122.36 is still mildly in favor to resume at a later stage. However, sustained break of 135.58/39 will confirm reversal and target a retest on 122.36 low.