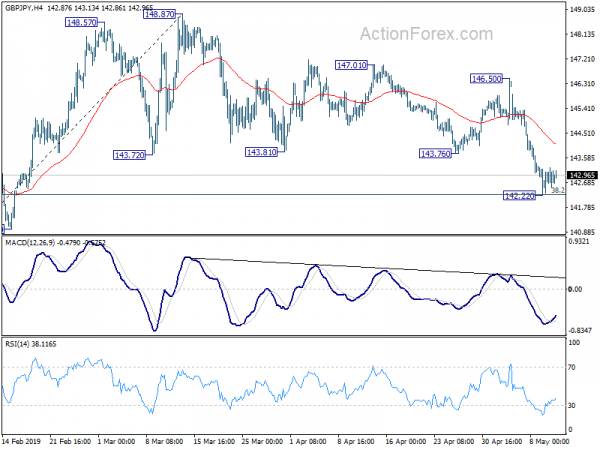

GBP/JPY dropped sharply to as low as 142.22 last week and broke 143.72 key support decisively. The development argues that whole rebound from 131.51 has completed at 148.87 already, ahead of 149.48 key resistance. Though, as a temporary low was formed just ahead of 38.2% retracement of 131.51 to 148.87 at 142.23, initial bias will be neutral this week for some consolidations first. Upside of recovery should be limited below 146.50 resistance to bring another decline. On the downside, break of 142.22 will resume the decline from 148.87 to 61.8% retracement at 138.14 next.

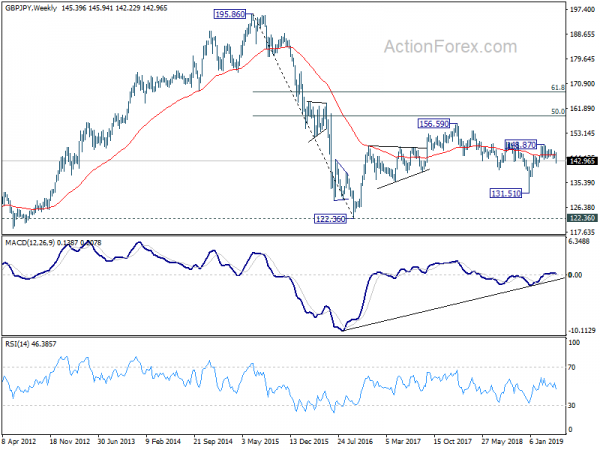

In the bigger picture, current development suggests that GBP/JPY was rejected by 149.98 key resistance. And medium term fall from 156.59 is still in progress. Break of 131.51 will target 122.36 (2016 low). On the other hand, decisive break of 149.98 should confirm that medium term fall from 156.59 (2018 high) has completed at 131.51 already. Further rally would be seen back to 156.59 resistance and above.

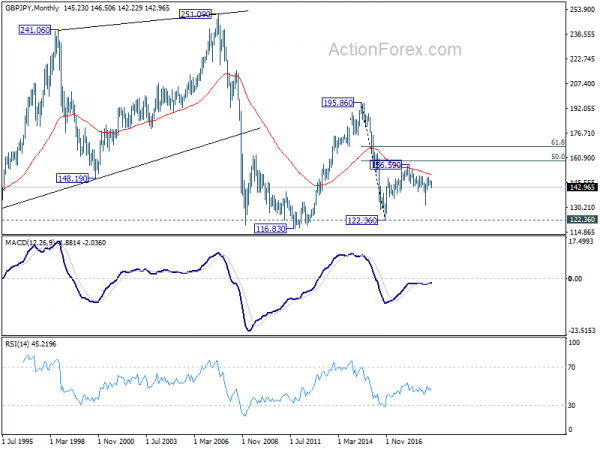

In the longer term picture, the rise from 122.36 (2016 low) to 156.59 (2018 high) doesn’t display a clear impulsive structure. Thus, we’re treating price actions from 122.36 as a corrective pattern. In case of an extension, strong resistance is likely to be seen at 50% retracement of 195.86 (2015 high) to 122.36 at 159.11 to limit upside. On the downside, break of 131.51 support will bring 122.26 low back into focus.