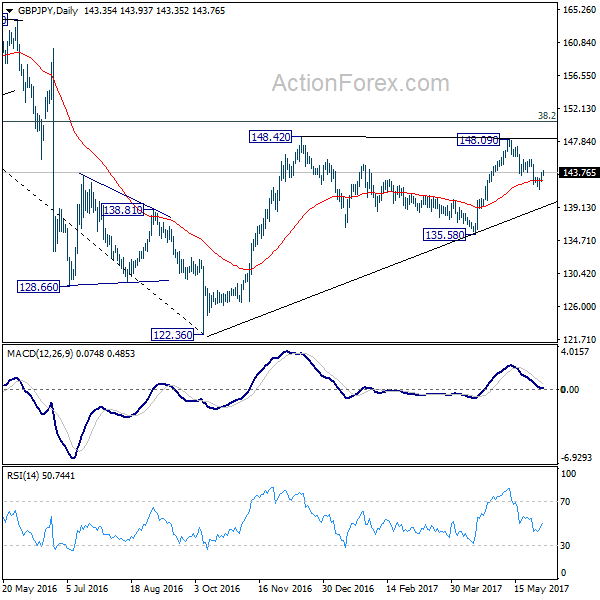

Daily Pivots: (S1) 142.70; (P) 143.20; (R1) 143.90; More….

Break of 141.3.36 minor resistance suggests short term bottoming at 141.43, on bullish convergence condition in 4 hours MACD. And, the pull back from 148.09 could have completed too. Intraday bias is turned back to the upside for 145.43 resistance first. Decisive break there should confirm this bullish case. And also, in that case, whole rally from 122.36 could be resuming through 148.42 resistance to long term fibonacci level at 150.42.

In the bigger picture, rise from 122.36 medium term bottom is still expected to extend to of 195.86 to 122.36 at 150.42. And decisive break there could pave the way to 61.8% retracement at 167.78. However, as the cross is starting to lose upside momentum, rejection below 150.42 and break of 135.58 support will indicate reversal and bring deeper fall back to retest 122.36 instead.