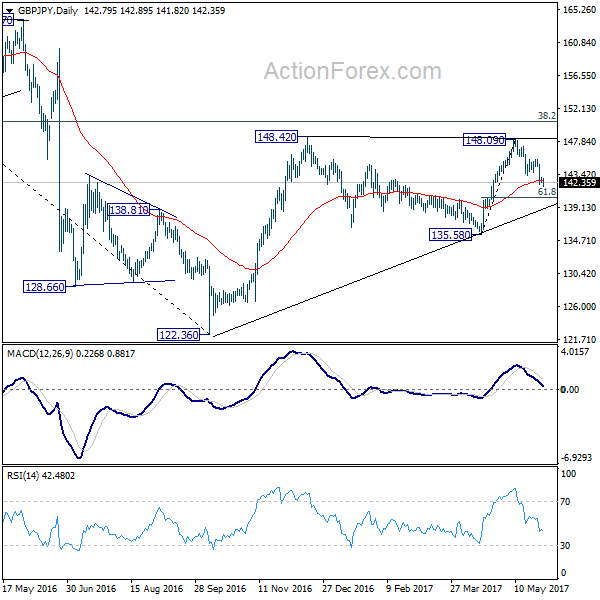

Daily Pivots: (S1) 142.40; (P) 142.73; (R1) 143.16; More….

GBP/JPY’s decline from 148.09 extends lower to as low as 141.82 so far and intraday bias remains on the downside. Deeper fall would be seen to 61.8% retracement of 135.58 to 148.09 at 140.35. At this point, we’d still expect rebound from 122.36 to resume later. Hence, we’d look for strong support below 140.35 to contain downside and bring rebound. On the upside, above 13.36 minor resistance will turn bias back to the upside. However, sustained trading below 140.35 will dampen our bullish view and turn focus back to 135.58 key near term support instead.

In the bigger picture, rise from 122.36 medium term bottom is still expected to extend to of 195.86 to 122.36 at 150.42. And decisive break there could pave the way to 61.8% retracement at 167.78. However, as the cross is starting to lose upside momentum, rejection below 150.42 and break of 135.58 support will indicate reversal and bring deeper fall back to retest 122.36 instead.