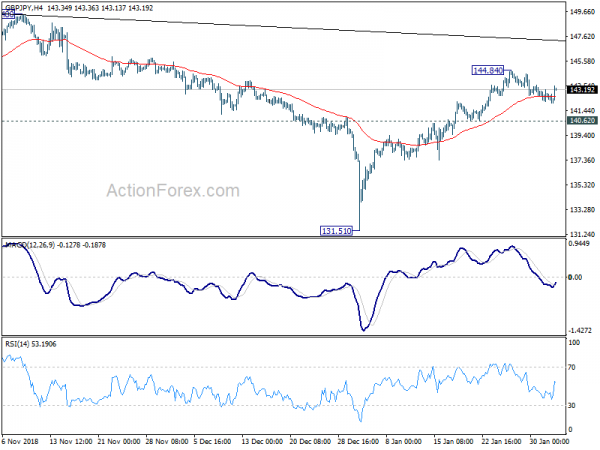

GBP/JPY retreated last week as price actions from 144.84 developed into consolidation pattern. Initial bias remains neutral this week first. Further rise is expected as long as 140.62 minor support holds. Break of 144.82 will resume the rebound from 131.51 to trendline resistance at around 147.23. We’d expect strong resistance from there to limit upside, at least on first attempt. On the downside, firm break of 140.62 will suggest completion of the rebound and turn bias to the downside.

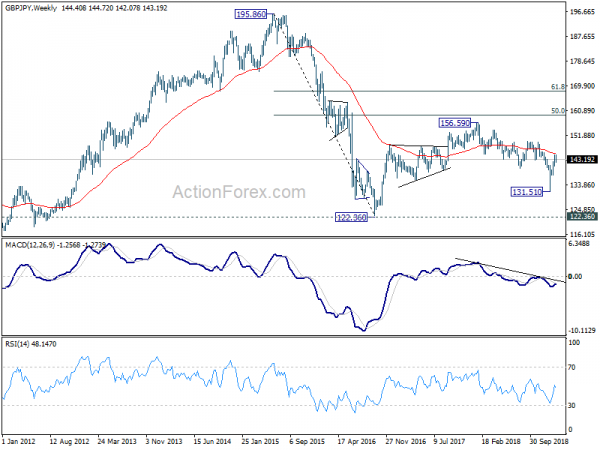

In the bigger picture, the strong rebound from 131.51 suggests that medium term fall from 156.59 (2018 high) has completed already. The corrective structure of such decline is turn argues that it’s the second leg of the corrective pattern from 122.36 (2016 low). And this pattern is starting the third leg. On the upside, decisive break of 149.38 will pave the way to 156.59 resistance and above.

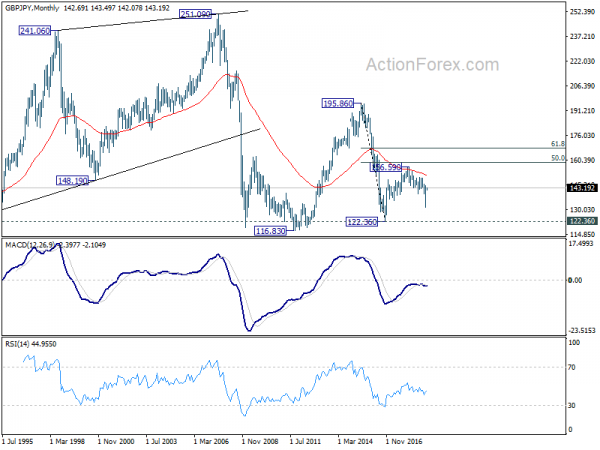

In the longer term picture, the rise from 122.36 (2016 low) to 156.59 (2018 high) doesn’t display a clear impulsive structure. Thus, we’re treating price actions from 122.36 as a corrective pattern. In case of an extension, strong resistance is likely to be seen at 50% retracement of 195.86 (2015 high) to 122.36 at 159.11 to limit upside. On the downside, break of 131.51 support will bring 122.26 low back into focus.