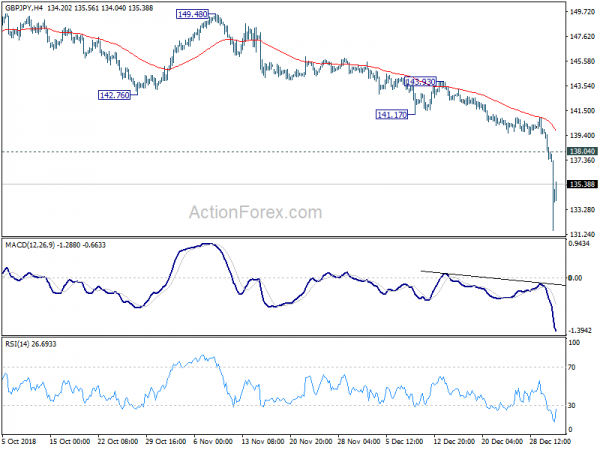

Daily Pivots: (S1) 136.44; (P) 138.18; (R1) 139.08; More…

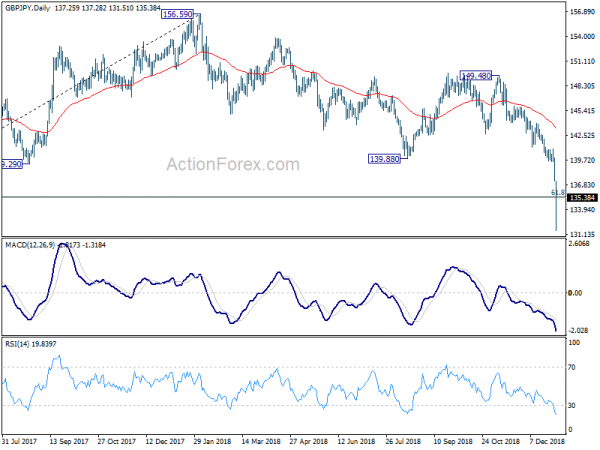

GBP/JPY’s decline accelerated further to as low as 131.51 and broke 135.43 fibonacci level. Some consolidation would likely be seen after climax selling. But outlook will stay bearish as long as 138.04 minor resistance holds. Sustained break of 135.43 will pave the way back to 122.36 (2016 low). Nevertheless, touching of 138.04 will confirm short term bottoming and bring lengthier consolidation first, before staging another fall.

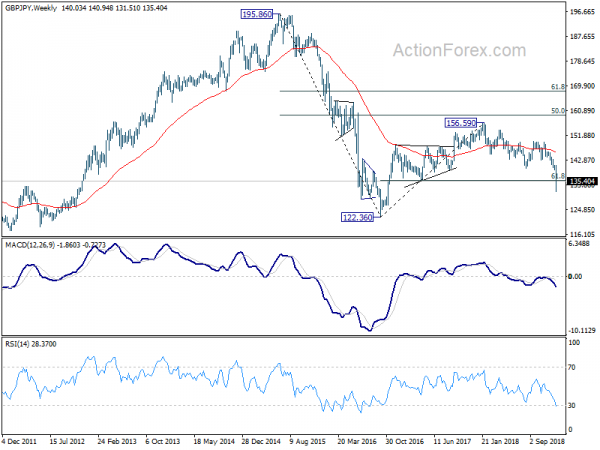

In the bigger picture, corrective medium term rise from 122.36 (2016 low) has completed at 156.69 already. That came after failing to break through 55 month EMA. Fall from 156.69 (2018 high) is seen as resuming the long term down trend from 195.86 (2015 high). Break of 122.36 will target 116.83 low first (2011 low). And this will now remain the preferred case as long as 139.88 support turned resistance holds.