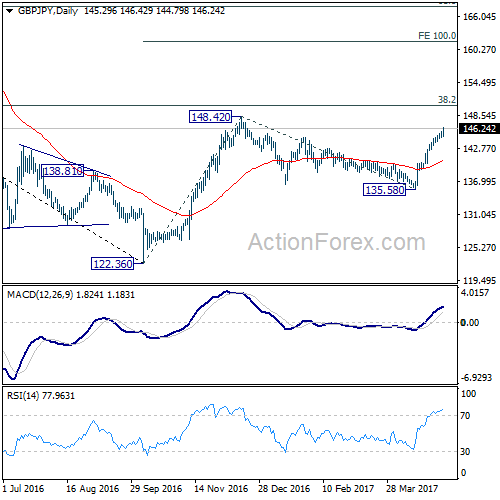

GBP/JPY surged to as high as 146.42 last week. The development was in line with the view of resumption of rise from 122.36. Further rally is expected through 148.42 resistance to 150.42 fibonacci level.

Initial bias in GBP/JPY remains on the upside for 148.42 resistance. Break will resume rise from 122.36 to 150.42 resistance. Further break there will target 100% projection of 122.36 to 148.42 from 135.58 at 161.64. On the downside, below 144.79 minor support will turn bias neutral and bring consolidation before staging another rise.

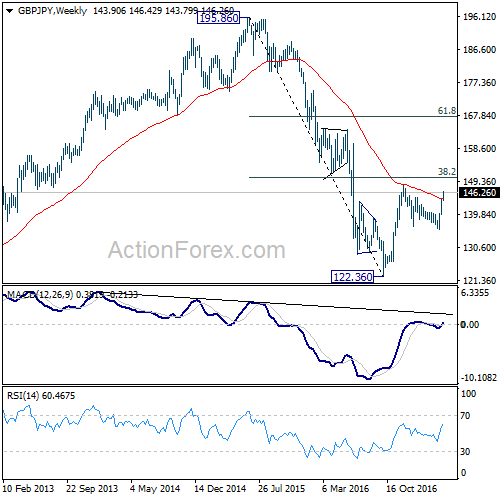

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.

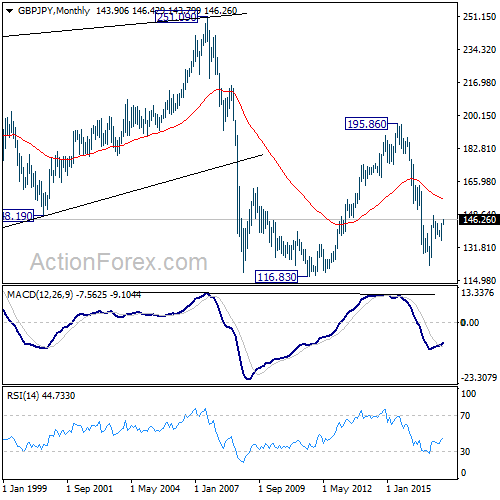

In the longer term picture, based on the impulsive structure of the decline from 195.86 to 122.36, such fall should not be completed yet. But we will now pay close attention to the structure of the rise from 122.36 to determine whether it’s a corrective move, or an impulsive move. That would decide whether a break of 116.83 low would be seen.