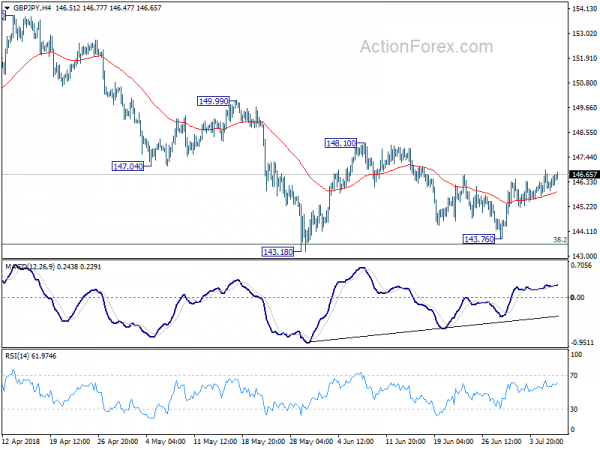

GBP/JPY’s rebound from 143.76 extended higher last week. But upside momentum has been rather unconvincing as seen in 4 hour MACD. Initial bias remains neutral this week first. On the upside, firm break of 148.10 resistance will be a strong signal of near term reversal. Further rally would be seen to 149.99 resistance for confirmation. On the downside, break of 143.18 low will extend the fall from 156.59 for 139.25/47 cluster support level.

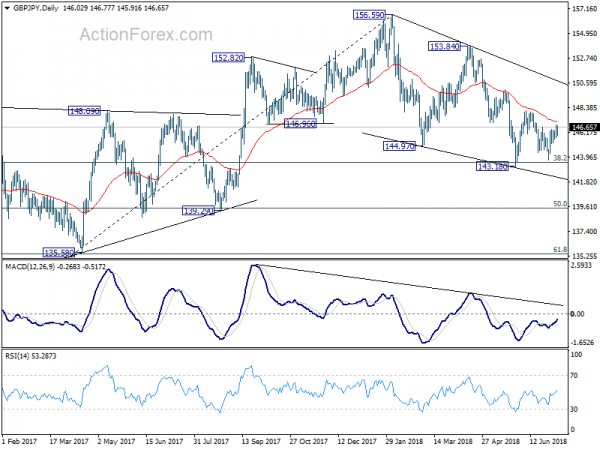

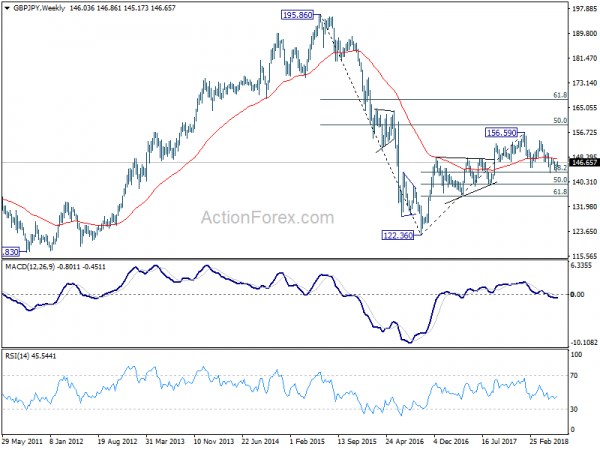

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.

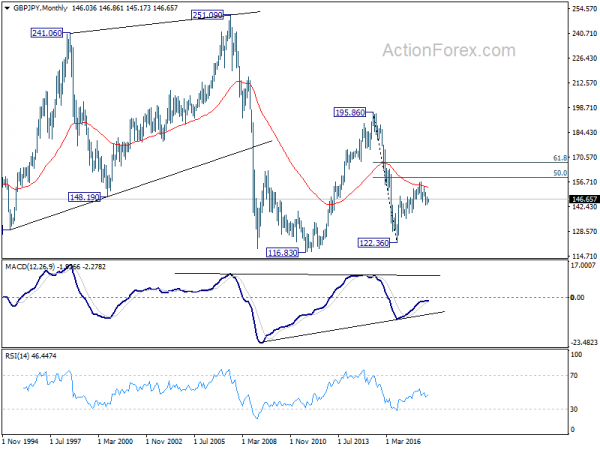

In the longer term picture, the failure to sustain above 55 month EMA (now at 153.56) is mixing up the outlook. Nonetheless, as long as 139.29 holds, rise from 122.26 is in favor to extend to 50% retracement of 195.86 (2015high) to 122.36 (2016 low) at 159.11, and possibly further to 61.8% retracement at 167.78 before completion. However, firm break of 139.29 will turn focus back to 116.83/122.36 support zone instead.