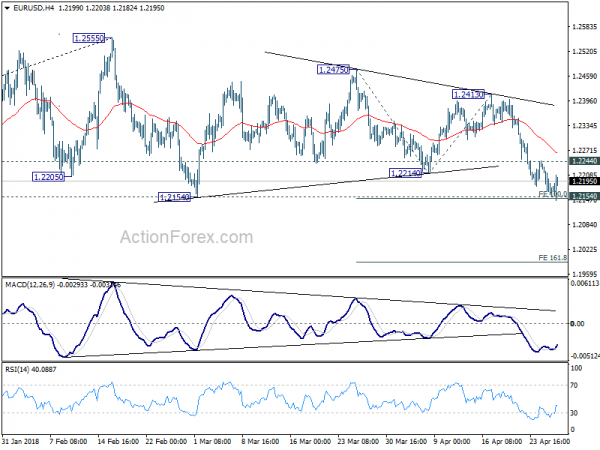

Daily Pivots: (S1) 1.2135; (P) 1.2186 (R1) 1.2213; More….

Despite breaching 1.2154 key support to 1.2145, EUR/USD quickly recovered. Intraday bias is turned neutral first. But further decline is still expected as long as 1.2244 minor resistance holds. As noted before, decisive break of 1.2154 should confirm the bearish case of medium term reversal. In addition, the break of 100% projection of 1.2475 to 1.2214 from 1.2413 will indicate downside acceleration. In that case, EUR/USD should target 161.8% projection at 1.1991 next. However, break of 1.2244 will indicate strong support from 1.2154 and turn intraday bias back to the upside for 1.2413, to extend recent range trading.

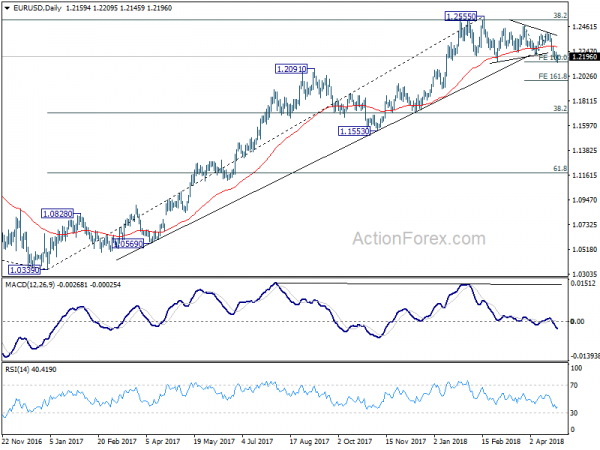

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Firm break of 1.2154 support will confirm rejection by this fibonacci level. And in that case, a medium term top is at least formed at 1.2555. EUR/USD should then head back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. We’ll look at the structure and momentum of such decline before decision if it’s an impulsive or corrective move.