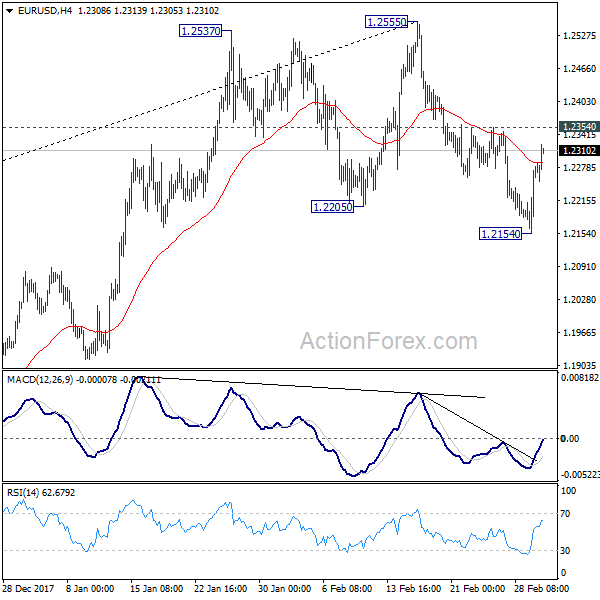

Daily Pivots: (S1) 1.2173; (P) 1.2207 (R1) 1.2227; More….

EUR/USD’s rebound from 1.2154 but stays below 1.2354 minor resistance. Intraday bias remains neutral first. On the upside, break of 1.2354 will indicate that pull back from 1.2555 has completed. In such case, intraday bias will be turned back to the upside for 1.2555 high. Break there will carry larger bullish implication. On the downside, break of 1.2154 will revive the case of trend reversal and turn outlook bearish for 38.2% retracement of 1.0339 to 1.2555 at 1.1708.

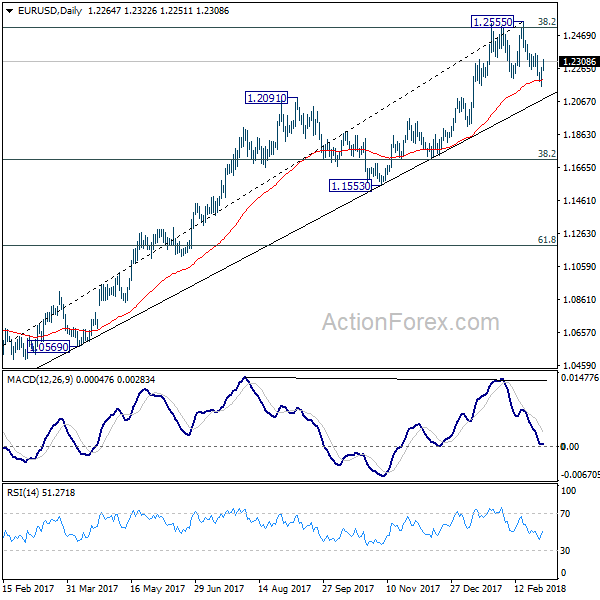

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.5553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.