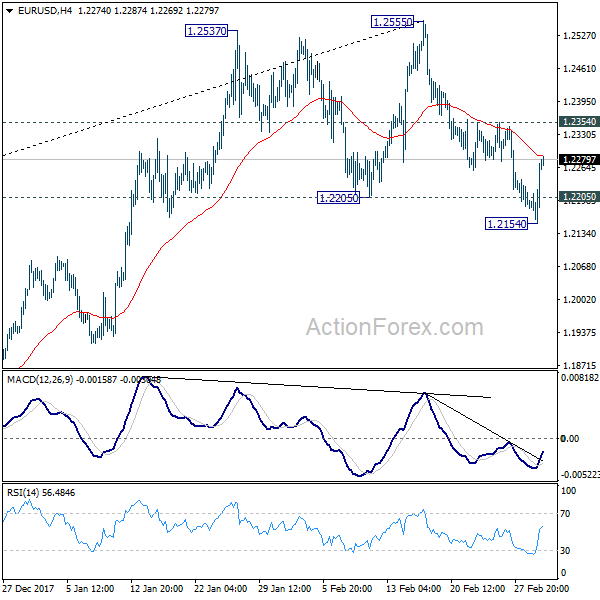

Daily Pivots: (S1) 1.2173; (P) 1.2207 (R1) 1.2227; More….

Despite dipping to 1.2154, EUR/USD could not sustain below 1.2205 key support and recovered. Intraday bias is turned neutral first. With 1.2354 resistance intact, we’re still favoring the case of trend reversal. That is, EUR/USD has topped at 1.2555 and was rejected by 1.2516 key fibonacci level. But sustained trading below 1.2205 is needed to confirm. Break of 1.2154 should send EUR/USD lower to 38.2% retracement of 1.0339 to 1.2555 at 1.1708. On the upside, above 1.2354 minor resistance will invalidate this bearish case and bring retest of 1.2555 high instead.

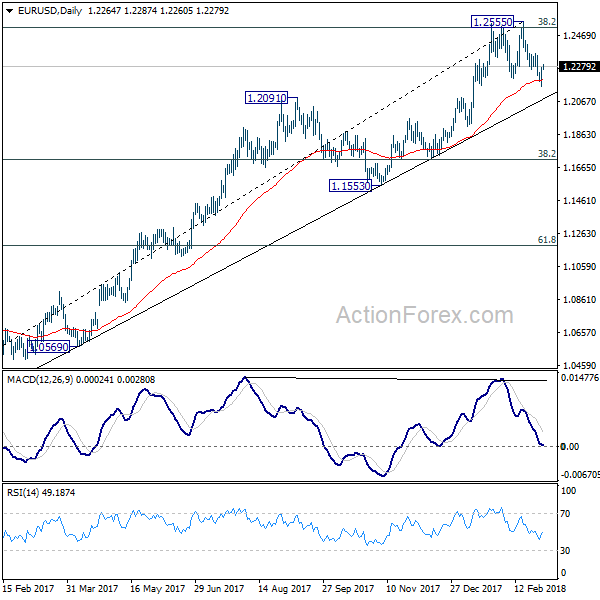

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.5553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.