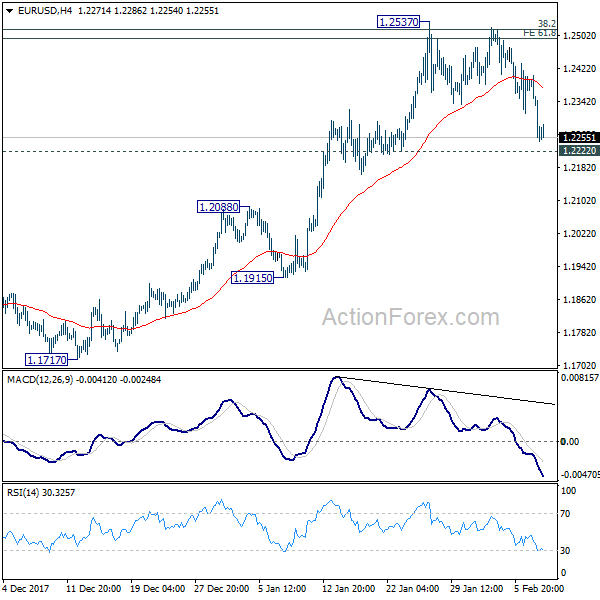

Daily Pivots: (S1) 1.2204; (P) 1.2305 (R1) 1.2364; More….

EUR/USD drops to as low as 1.2245 so far. Downside acceleration as seen in 4 hour MACD is raising the chance of trend reversal. But we’d prefer to see decisive break of 1.2222 support to confirm. Sustained break of 1.2222 will indicate rejection from 1.2494/2516 key fibonacci level, on bearish divergence condition in 4 hour MACD. That could also signal completion of medium term up trend from 1.0339. In that case, near term outlook will be turned bearish for 1.2091 resistance turned support first.

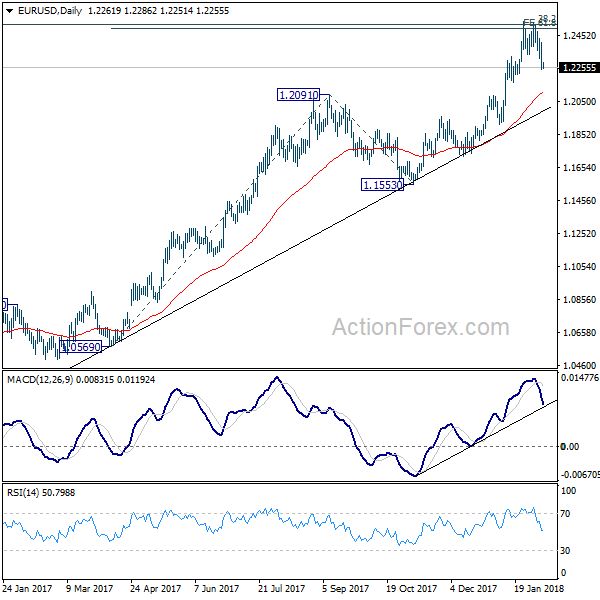

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. But key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 is looking vulnerable. Sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862. Nonetheless, rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive.