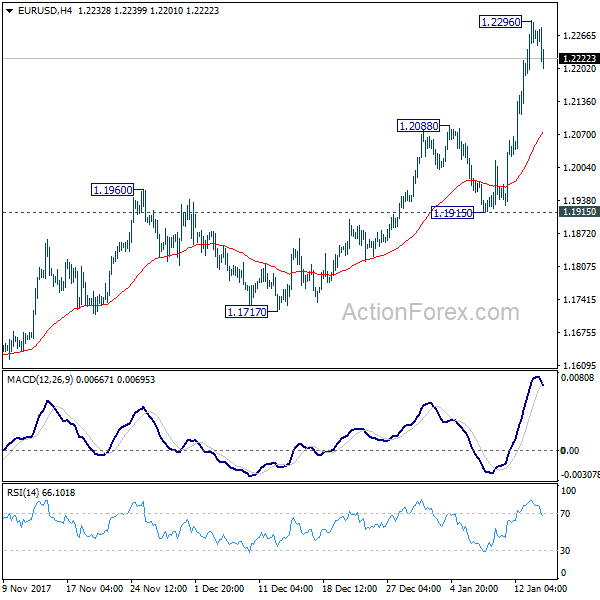

Daily Pivots: (S1) 1.2202; (P) 1.2249 (R1) 1.2311; More….

A temporary top is in place at 1.2296 with the current retreat. Intraday bias in EUR/USD is turned neutral for consolidations. Near term outlook will remain bullish as long as 1.1915 support holds. Above 1.2296 will extend the medium term rally to 1.2494/2516 key resistance zone next. At this point, we’d expect strong resistance from there to limit upside and bring reversal. Meanwhile, firm break of 1.1915 will argue that the medium term trend is reversing earlier than expected.

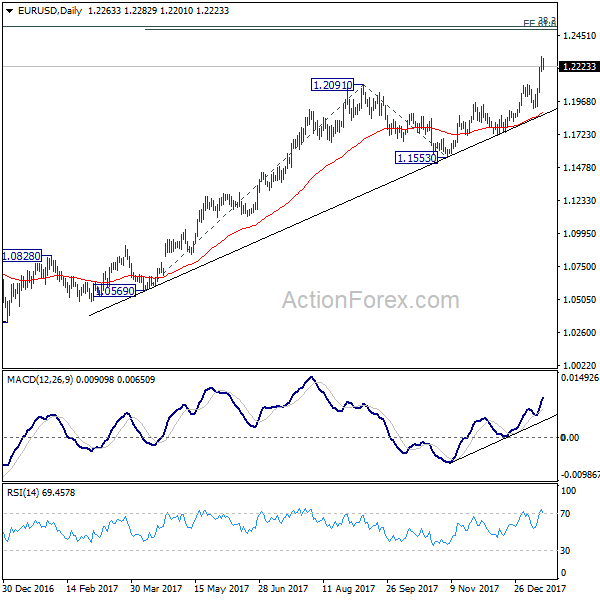

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 38.2% retracement of 1.6039 to 1.0339 at 1.3862.