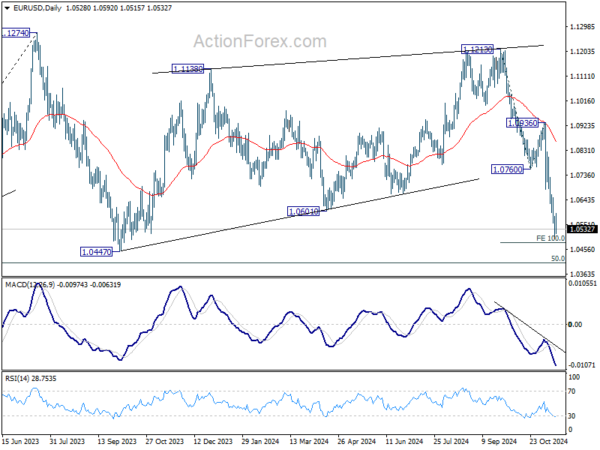

EUR/USD’s decline from 1.1213 resumed last week and fell to as low as 1.0495, before recovering just ahead of 100% projection of 1.1213 to 1.0760 from 1.0936 at 1.0483. Initial bias stays neutral this week for consolidations. But outlook will remain bearish as long as 1.0760 support turned resistance holds. On the downside, firm break of 1.0495 will target 1.0447 support and then 1.0404 key fibonacci level next.

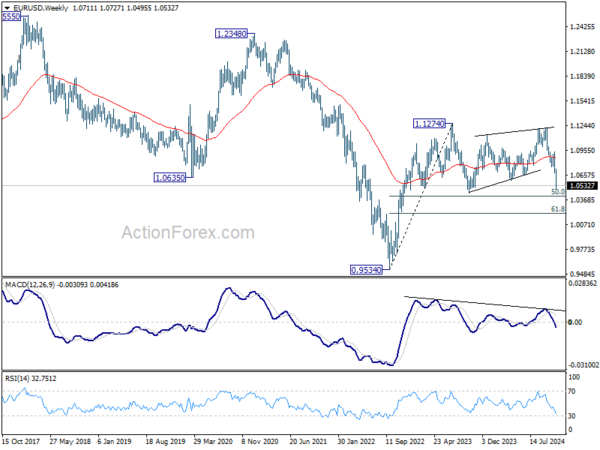

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage. However, firm break of 1.0404 will raise the chance of reversal and target 61.8% retracement at 1.0199.

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). But for now, EUR/USD is struggling to sustain above 55 M EMA (now at 1.1011). Outlook is neutral at best at this point.