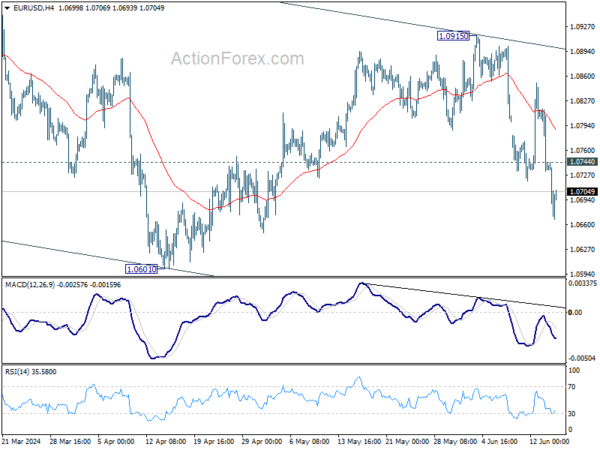

Euro’s strong decline last week suggests that rebound from 1.0601 has already completed as a correction to 1.0915. Initial bias stays on the downside this week for retesting 1.0601 low first. Firm break there will target channel support at 1.0510 next. On the upside, above 1.0744 minor resistance will turn intraday bias neutral again first.

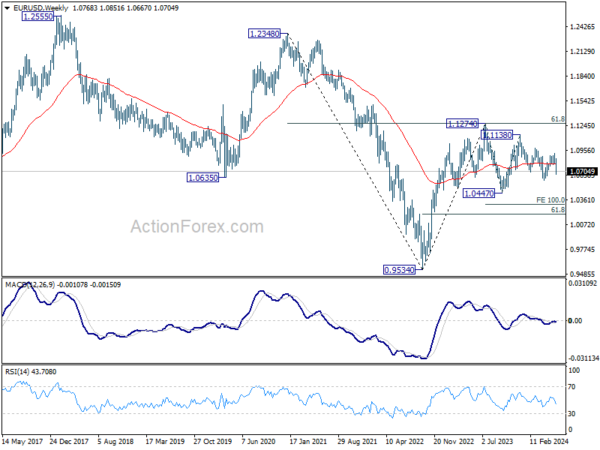

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly further to 100% projection of 1.1274 to 1.0447 from 1.1138 at 1.0311. For now, this will remain the favored case as long as 1.0915 resistance holds, in case of rebound.

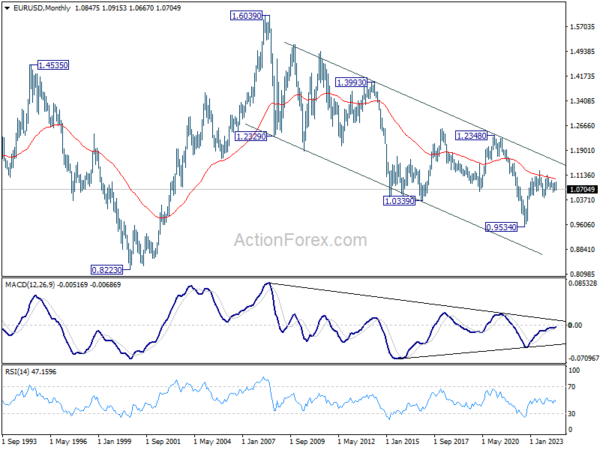

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). But considering that upside is still capped below 55 M EMA (now at 1.1030), there is no sign of trend reversal yet. Down trend from 1.6039 (2008 high) could resume at a later stage if current selloff picks up momentum.