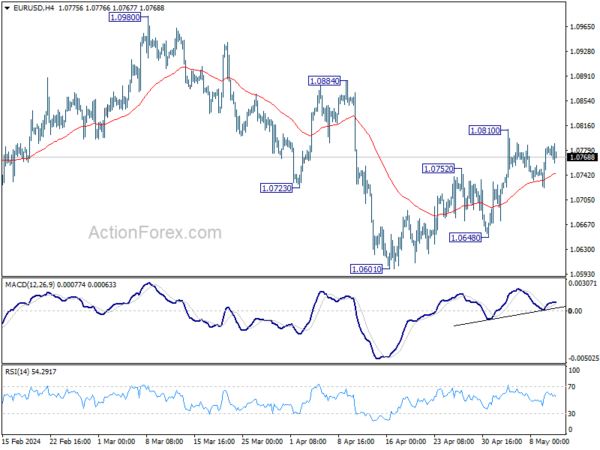

EUR/USD stayed in consolidation below 1.0810 last week. Initial bias stays neutral this week but further rally is expected as long as 55 4H EMA (now at 1.0744) holds. On the upside, above 1.0810 will resume the rebound from 1.0601 to 1.0884 resistance next. However, firm break of 55 4H EMA will argue that the rebound has completed, and turn bias to the downside for 1.0648 support instead.

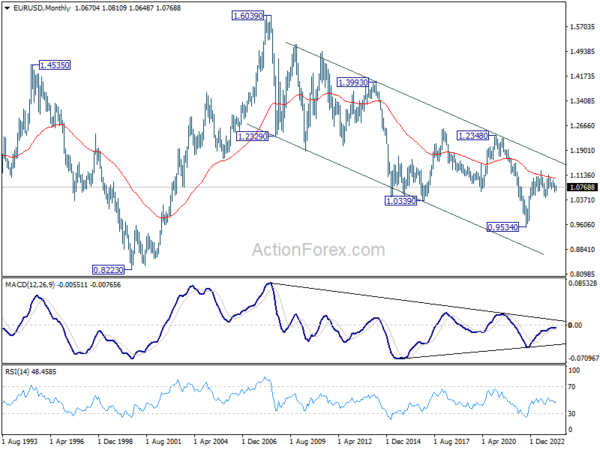

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. It’s still early to call for bullish trend reversal with the pair staying inside falling channel in the monthly chart. Nevertheless, sustained trading above 55 M EMA (now at 1.1027) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.