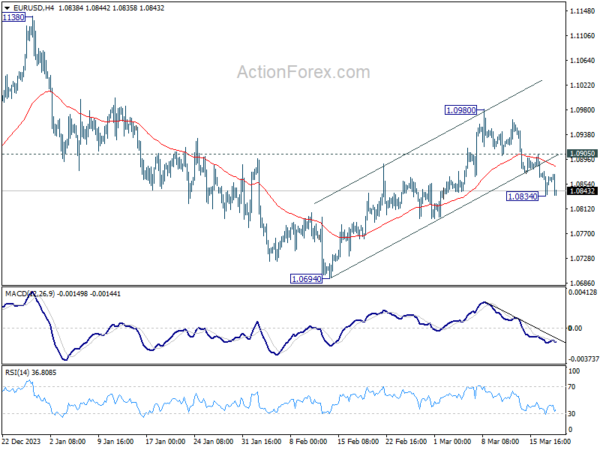

Daily Pivots: (S1) 1.0842; (P) 1.0859; (R1) 1.0884; More…

Intraday bias in EUR/USD remains neutral for consolidation above 1.0834 temporary low. Further decline is in favor as long as 1.0905 resistance holds. On the downside, sustained trading below 55 D EMA (now at 1.0856) will argue that rebound from 1.0694 has completed and bring retest of this low. However, above 1.0905 will turn bias back to the upside for 1.0980 resistance instead.

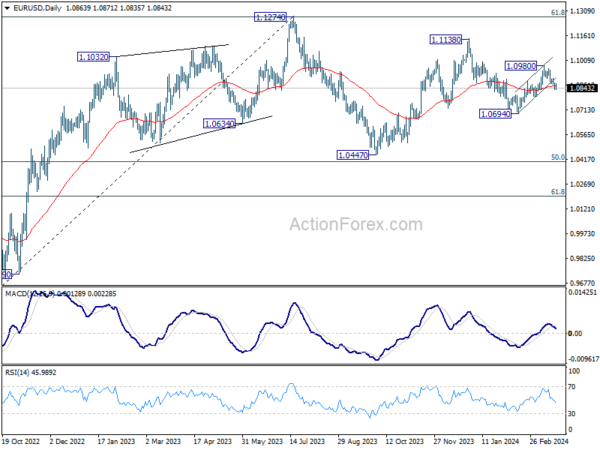

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.