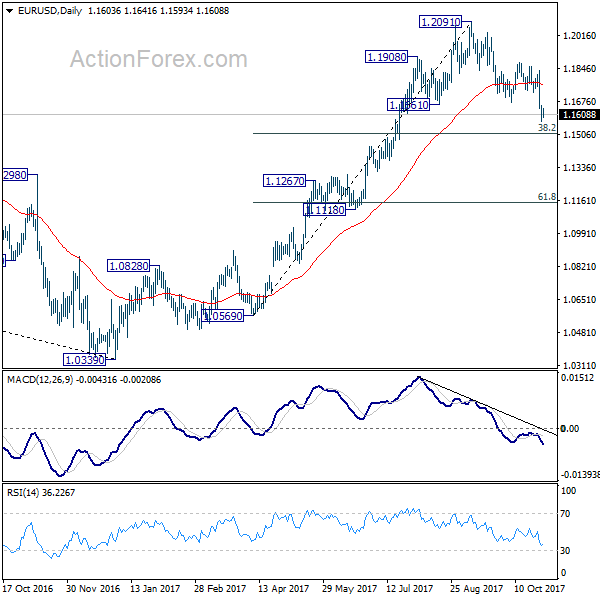

Daily Pivots: (S1) 1.1568; (P) 1.1612 (R1) 1.1651; More…

With 1.1643 minor resistance intact, intraday bias in EUR/USD remains on the downside for 38.2% retracement of 1.0569 to 1.2091 at 1.1510. We’d expect strong support from there, at least on first attempt, to bring rebound. Above 1.1643 minor resistance will turn bias neutral first. But break of 1.1879 is needed to confirm completion of the decline. Otherwise, near term outlook remains bearish. Meanwhile, sustained break will of 1.1510 will carry larger bearish implication and target 55 week EMA (now at 1.1346).

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.