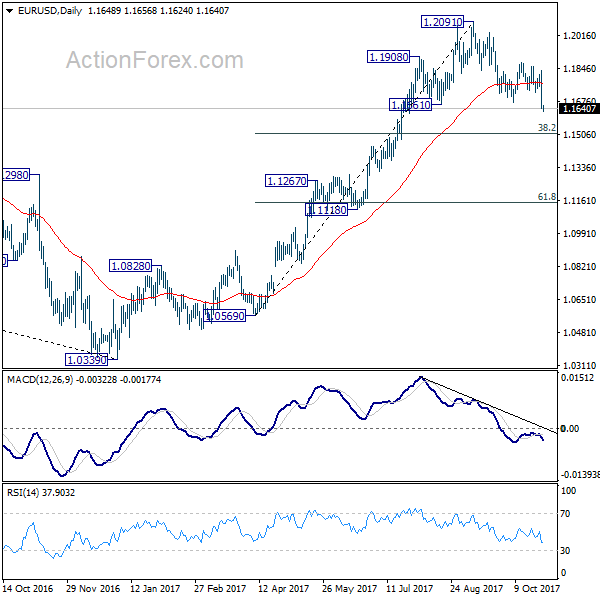

Daily Pivots: (S1) 1.1582; (P) 1.1709 (R1) 1.1779; More…

EUR/USD dives to as low as 1.1624 so far today. The break of 1.1669 support confirms resumption of whole fall from 1.2091. Intraday bias is back on the downside for 38.2% retracement of 1.0569 to 1.2091 at 1.1510 next. At this point, such decline is still viewed as a correction. Hence, we’d expect strong support from 1.1510 to bring rebound, at least during first attempt. However, firm break there will bring deeper decline to 61.8% retracement at 1.1150. On the upside, above 1.1724 support turned resistance will turn intraday bias neutral first. But near term outlook will remain bearish as long as 1.1879 resistance holds.

In the bigger picture, rise from medium term bottom at 1.0339 is not finished yet. It’s expected to continue after pull back from 1.2091 completes. And, next target will be 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside.