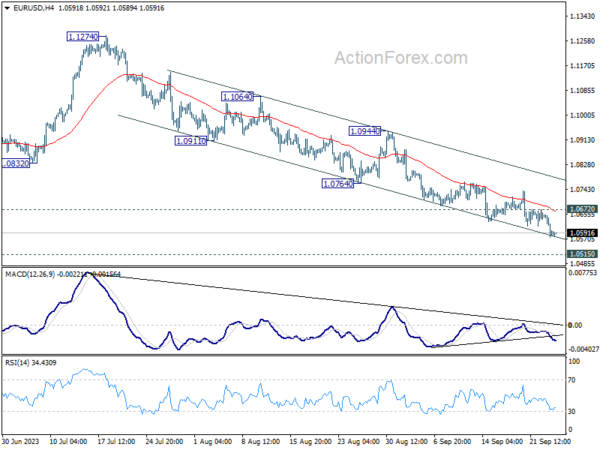

Daily Pivots: (S1) 1.0616; (P) 1.0644; (R1) 1.0673; More…

Intraday bias in EUR/USD is back on the downside as fall from 1.1274 resumed after brief consolidations. Sustained trading below 1.0609/34 cluster support will carry larger bearish implication, and target 1.0515 support next. On the upside, above 1.0672 minor resistance will turn intraday bias neutral and bring consolidations. But outlook will stay bearish as long as 1.0764 support turned resistance holds.

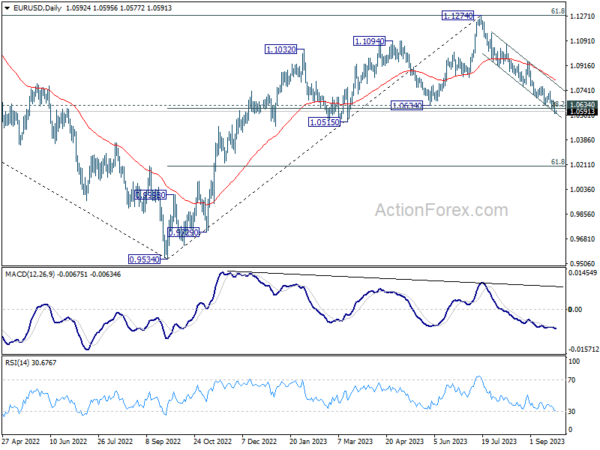

In the bigger picture, focus stays on 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Sustained trading below there would rase the chance of bearish trend reversal. That is, fall from 1.1274 could be reversing whole rise from 0.9534 (2022 low). But even if it’s just a corrective move, deeper decline would be seen to 61.8% retracement at 1.0199. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0825) holds, in case of rebound.