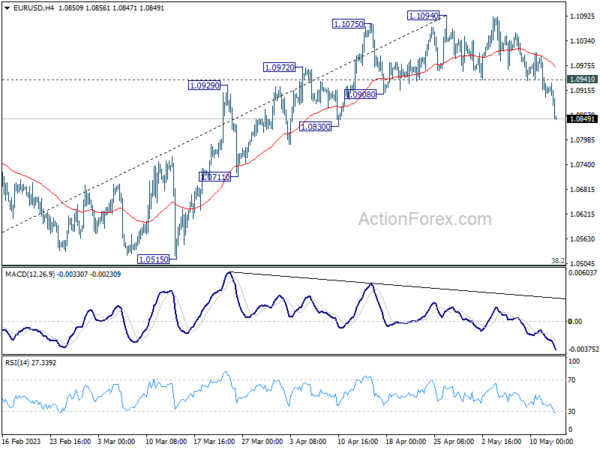

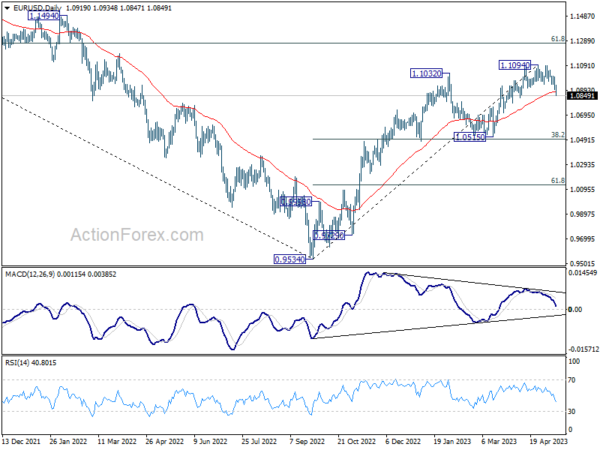

EUR/USD reversed after failing to break through 1.1094 resistance last week, and break of 1.0908 support confirmed short term topping. More importantly, considering bearish divergence condition in D MACD and break of 55 D EMA (now at 1.0880), it’s possibly in correction to whole up trend from 0.9534 already. Initial bias stays on the downside this week for 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498. On the upside, though, above 1.0941 resistance will turn bias back to the upside for retesting 1.1094 high.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

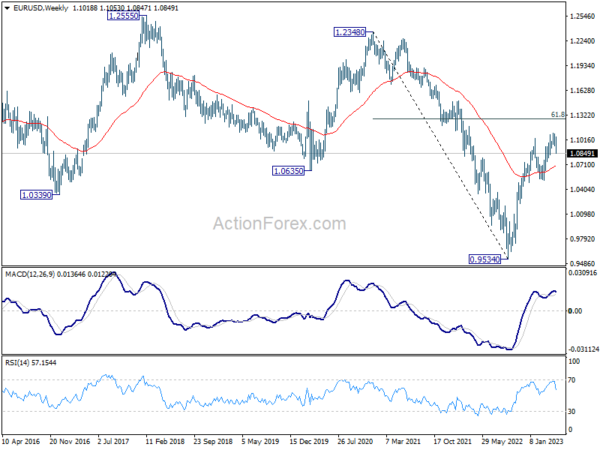

In the long term picture, while it’s still early to call for long term trend reversal at this point, the strong break of 1.0635 support turned resistance (2020 low) should at least turn outlook neutral. Focus is now on 55 M EMA (now at 1.1156). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be an indication underlying bullishness and target 1.2348 resistance next.