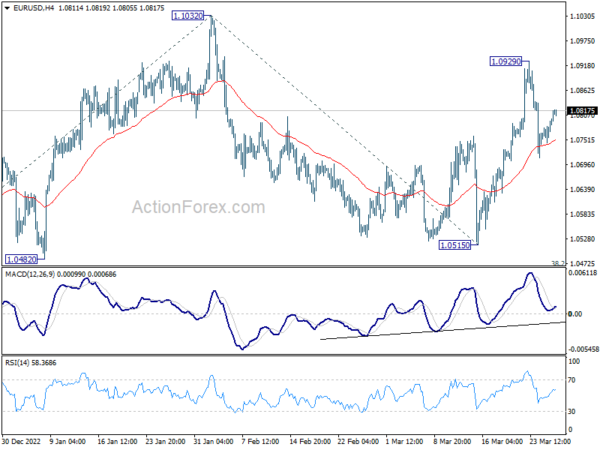

Daily Pivots: (S1) 1.0762; (P) 1.0782; (R1) 1.0820; More…

Intraday bias in EUR/USD remains neutral for the moment. Strong rebound from current level, followed by break of 1.0929 will reaffirm near term bullishness, and extend the rise from to retest 1.1032 high. Firm break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level next. However, sustained trading below 4 hour 55 EMA (now at 1.0750) will likely extend the corrective pattern from 1.1032 and bring deeper decline back towards 1.0515.

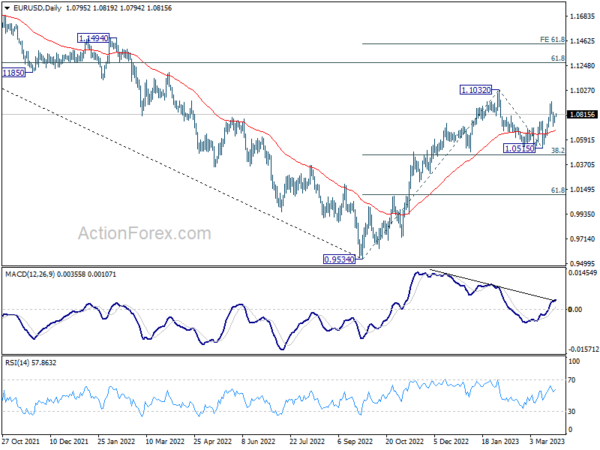

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0623) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidity the case of bullish trend reversal and target 1.2348 resistance next (2021 high).