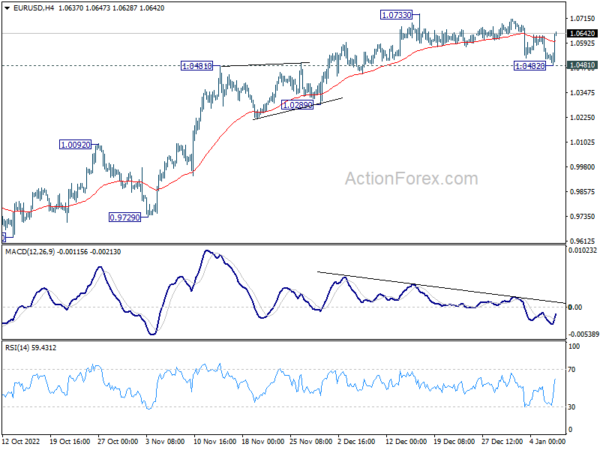

EUR/USD dropped to 1.0482 last week as consolidation from 1.0733 extended. But downside was contained by 1.0481 resistance support. Initial bias stays neutral this week first. On the upside, firm break of 1.0733 will resume whole rally from 0.9534. Nevertheless, sustained break of 1.0481 will extend the correction to 1.0289 support and below.

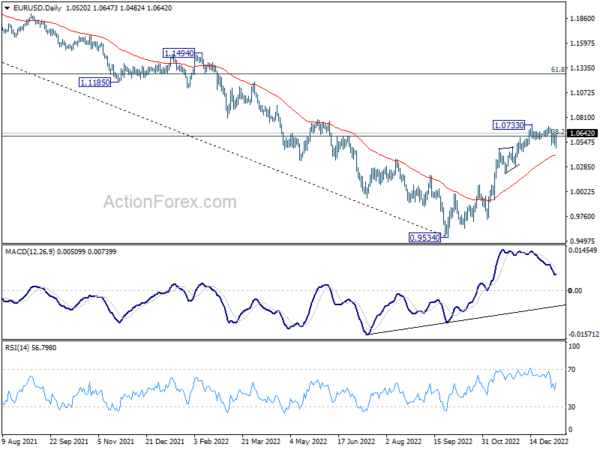

In the bigger picture, focus stays on 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Rejection by 1.0609 will suggest that price actions from 0.9534 medium term bottom are developing into a corrective pattern. Thus, medium bearishness is retained for another fall through 0.9534 at a later stage. However, sustained break of 1.0609 will raise the chance of trend reversal and target 61.8% retracement at 1.1273.

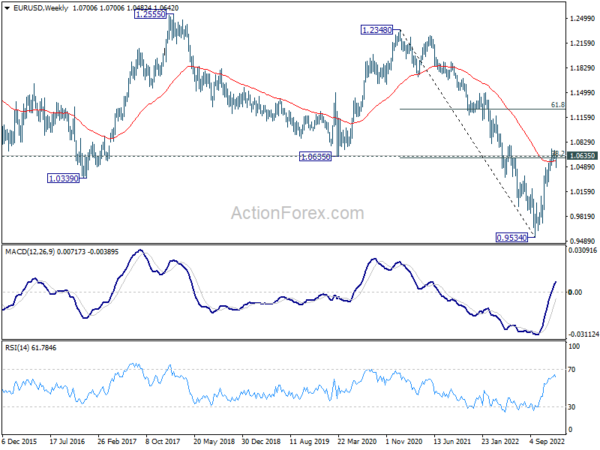

In the long term picture, as long as 1.0635 support turned resistance holds (2020 low), long term down trend from 1.6039 (2008) could still extend through 0.9534 at a later stage. However, sustained break of 1.0635 will confirm bottoming and at least turn long term outlook neutral.