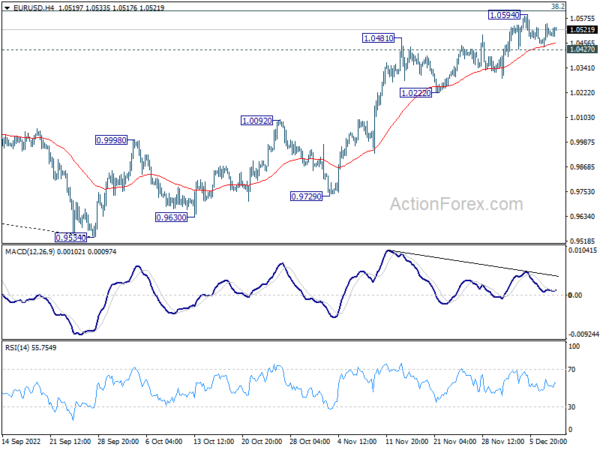

Daily Pivots: (S1) 1.0449; (P) 1.0500; (R1) 1.0556; More…

Intraday bias in EUR/USD stays neutral as range trading continues. Considering bearish divergence condition in 4 hour MACD, break of 1.0427 minor support will indicate short term topping at 1.0594, after rejection by 1.0609 fibonacci level. Intraday bias will be turned back to the downside for 1.0222 support and possibly below. Nevertheless, firm break of 1.0594 will resume larger rally from 0.9534.

In the bigger picture, a medium term bottom was in place at 0.9534, on bullish convergence condition in daily MACD. Even as a corrective rise, rally from 0.9534 should target 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Sustained trading above 55 week EMA (now at 1.0557) will raise the chance of trend reversal and target 61.8% retracement at 1.1273. However, rejection by 1.0609 will retain medium term bearishness for down trend resumption at a later stage.