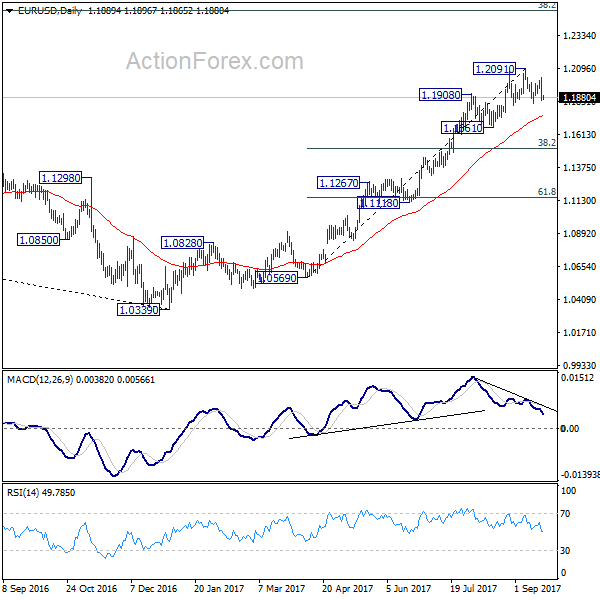

Daily Pivots: (S1) 1.1826; (P) 1.1929 (R1) 1.1998; More…

EUR/USD dropped sharply overnight but it’s staying in range of 1.1822/2091 so far. Intraday bias remains neutral first. The development is raising chance of a head and should top reversal pattern (ls: 1.2069, h: 1.2091, rs: 1.2029). Break of 1.1822/1837 support zone should confirm near term reversal. In the case, intraday bias will be turned back to the downside through 1.1661 support. EUR/USD should then correct whole rise from 1.0569 and target 38.2% retracement of 1.0569 to 1.2091 at 1.1510. However, rebound from 1.1822/1837 and break of 1.2029 will resume the larger up trend to next key fibonacci level at 1.2516.

In the bigger picture, rise from medium term bottom at 1.0339 is still in progress for 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall fro 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside. But after all, break of 1.1661 is needed to indicate medium term topping. Otherwise, outlook will remain bullish in case of pull back.