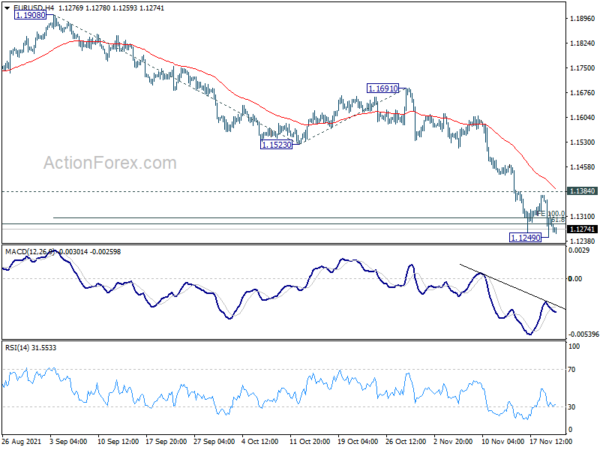

Daily Pivots: (S1) 1.1231; (P) 1.1302; (R1) 1.1354; More…

Intraday bias in EUR/USD remains neutral for the moment. On the downside, break of 1.1249 and sustained trading below 1.1289 long term fibonacci level will carry larger bearish implications. Deeper fall would then be seen to 161.8% projection of 1.1908 to 1.1523 from 1.1691 at 1.1068 next. Nevertheless, break of 1.1384 minor resistance will now indicate short term bottoming, and turn bias back to the upside for rebound.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.