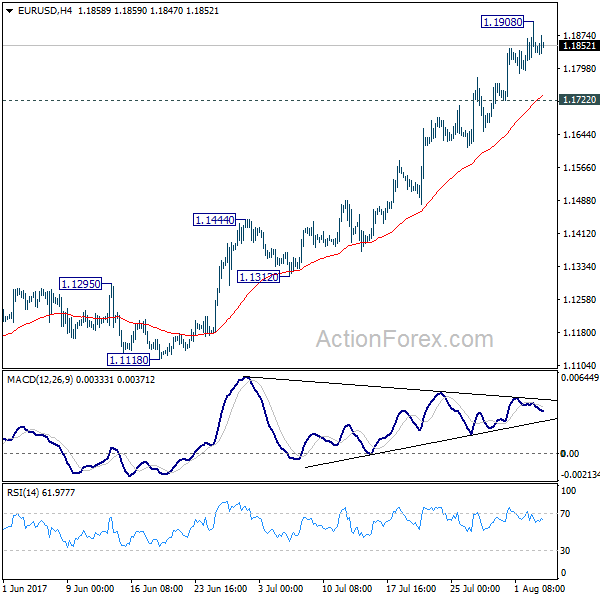

Daily Pivots: (S1) 1.1795; (P) 1.1853 (R1) 1.1912; More…

Intraday bias in EUR/USD remains neutral for consolidation below 1.1908 temporary top. Another rise is expected as long as 1.1722 support holds. Above 1.1908 will target 1.2 psychological level. Considering bearish divergence condition in 4 hour MACD, we’ll be cautious on topping around there to bring correction. On the downside, break of 1.1722 will indicate short term topping and bring deeper pull back to 55 day EMA (now at 1.1379).

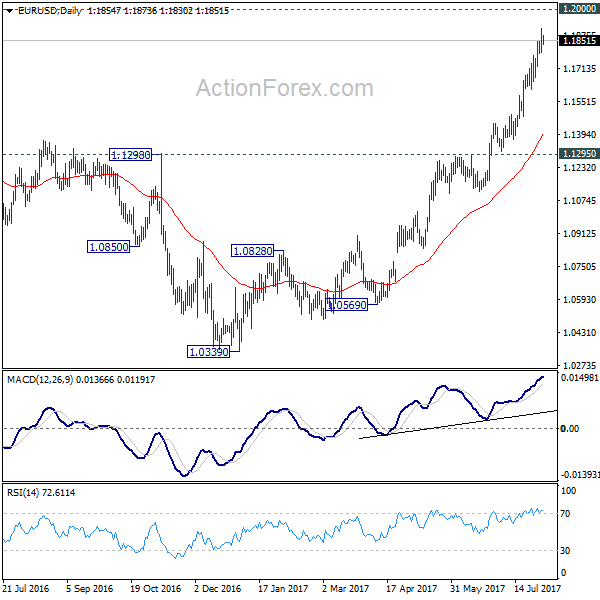

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained break of 55 month EMA (now at 1.1760) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. But for now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.