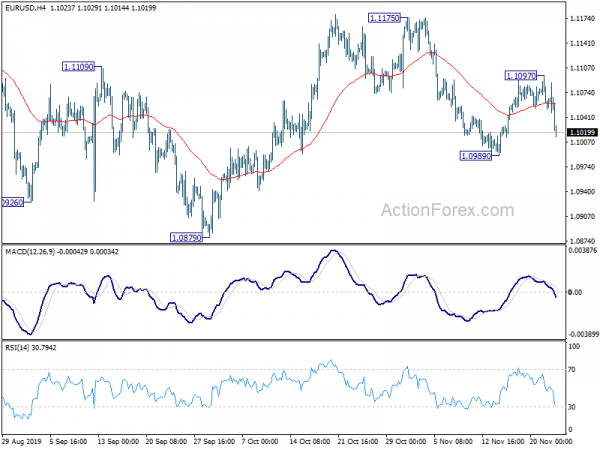

EUR/USD edged higher to 1.1097 last week but reversed from there and dropped sharply. The failure to sustain above 55 day EMA is a sign of near term bearishness. Initial bias stays on the downside this week for 1.0989 support first. Break will reaffirm the case that corrective rise from 1.0879 has completed at 1.1175. Deeper fall should then be seen to retest 1.0879 low. For now, risk will stay on the downside as long as 1.1097 resistance holds, in case of recovery.

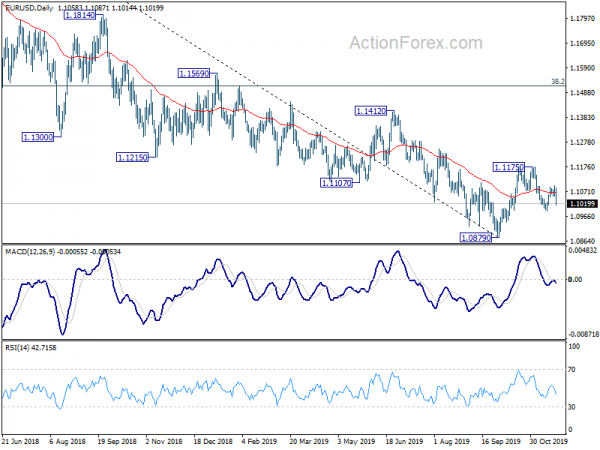

In the bigger picture, at this point, rebound from 1.0879 is seen as a corrective move first. in case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

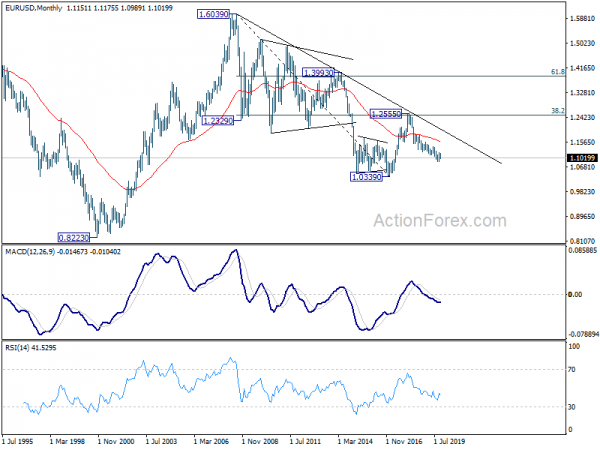

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1568) holds.