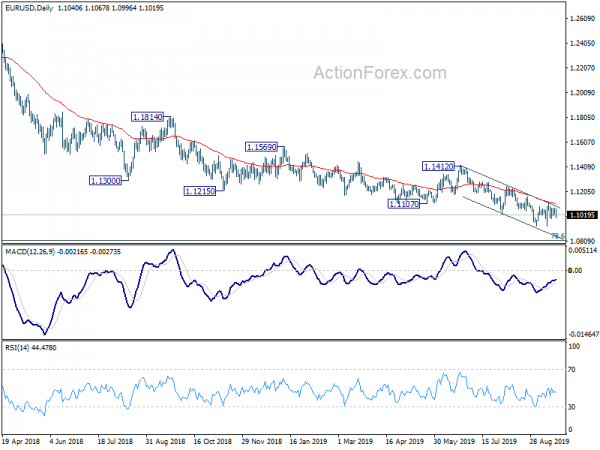

EUR/USD stayed in consolidation above 1.0926 last week and outlook is unchanged. Initial bias remains neutral this week first. Outlook stays bearish with 1.1164 resistance intact and further fall is expected. On the downside, sustained break of 1.0926 will resume lager down trend from 1.2555 for 1.0813 fibonacci level next. However, decisive break of 1.1164 will be an early indication of larger reversal and target 1.1249 resistance.

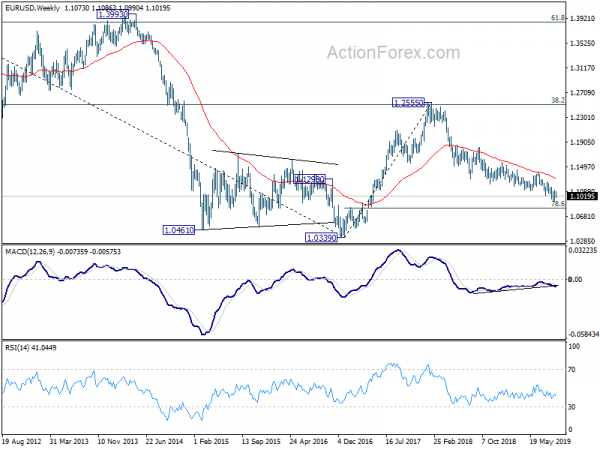

In the bigger picture, down trend from 1.2555 (2018 high) is in progress. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

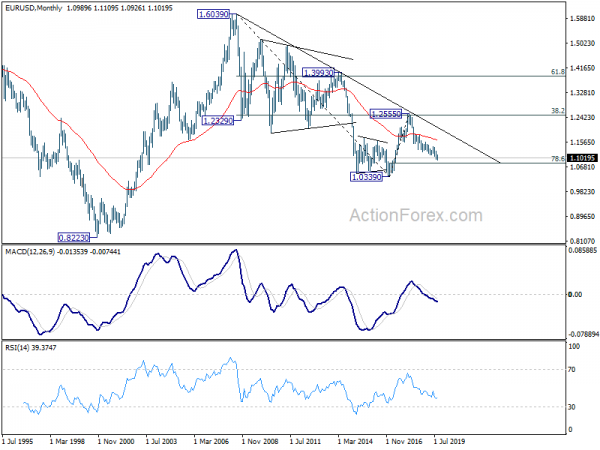

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1607) holds.