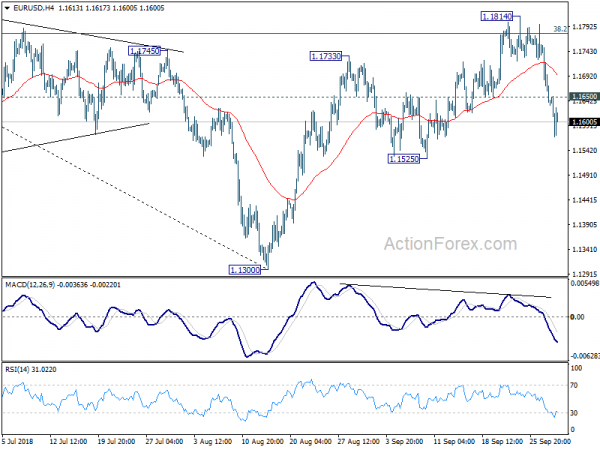

EUR/USD’s sharp decline last week argues that corrective rise from 1.1300 has completed at 1.1814. That came after failing to sustain above 38.2% retracement of 1.2555 to 1.1300 at 1.1779, on bearish divergence condition in 4 hour MACD. Initial bias stays on the downside this week for 1.1525 support first. Break should confirm this bearish case and target a test on 1.1300 low first. On the upside, above 1.1650 minor resistance will turn intraday bias neutral and bring recovery. But upside should be limited well below 1.1814 to bring fall resumption.

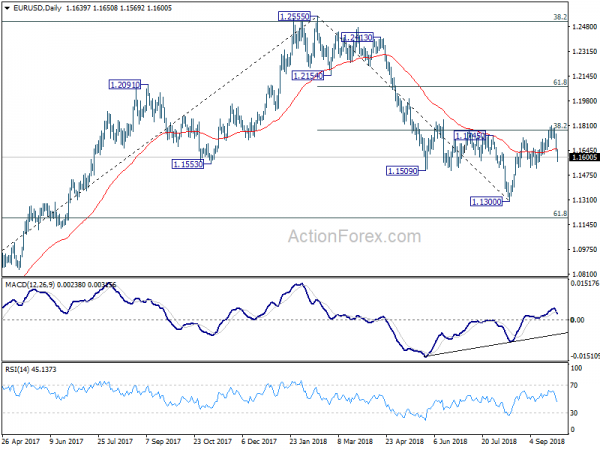

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

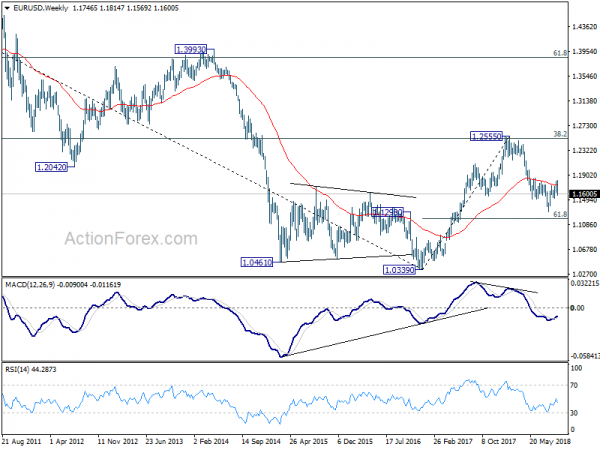

In the long term picture, the rejection from 38.2% retracement of 1.6039 to 1.0339 at 1.2516 argues that long term down trend from 1.6039 (2008 high) might not be over yet. EUR/USD is also held below decade long trend line resistance. Firm break of 61.8% retracement of 1.0339 to 1.2555 at 1.1186 should at least bring a retest on 1.0339 low.