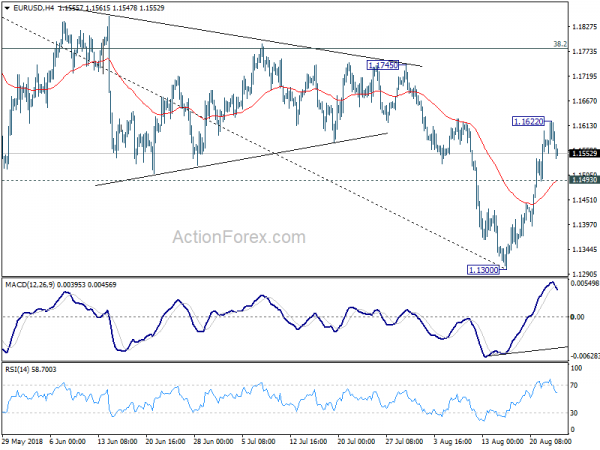

Daily Pivots: (S1) 1.1559; (P) 1.1591; (R1) 1.1630; More…..

A temporary top is in place at 1.1622 in EUR/USD and intraday bias is turned neutral. For now, rebound from 1.1300 is still seen as a correction. In case of another rise, we’d expect strong resistance from 1.1745 to limit upside to bring larger down trend resumption. On the downside, break of 1.1493 minor support will suggest that the rebound is completed. Intraday bias would be turned back to the downside for retesting 1.1300 low.

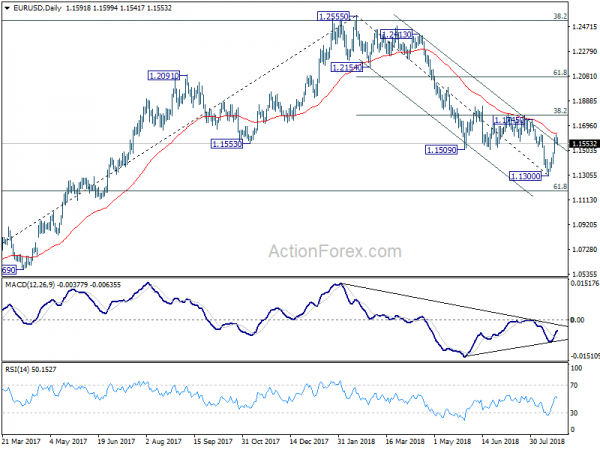

In the bigger picture, the down trend from 1.2555 medium term is in progress for 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Note again that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Sustained break of 1.1186 could pave the way back to retest 1.0339 low. For now, outlook will remain bearish as long as 38.2% retracement of 1.2555 to 1.1300 at 1.1779 holds, even in case of strong rebound.