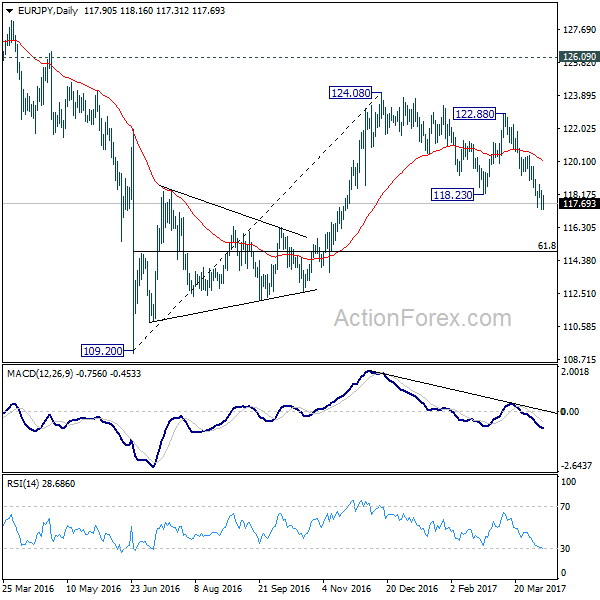

Daily Pivots: (S1) 117.38; (P) 117.90; (R1) 118.44; More…

Downside momentum in EUR/JPY is a bit unconvincing with 4 hour MACD staying above signal line. But with 118.78 minor resistance intact, deeper decline is expected. Current development suggests that medium term rise from 109.20 has completed at 124.08 already. Further fall should be seen to 61.8% retracement of 109.20 to 124.08 at 114.88 next. On the upside, above 118.78 will indicate short term bottoming and bring rebound back to 119.31/120.43 resistance zone.

In the bigger picture, the firm break of 38.2% retracement of 109.20 to 124.08 at 118.39 indicates that medium term rise from 109.20 is completed at 124.08. That’s well below 126.09 key support turned resistance. Also, EUR/JPY failed to sustain above 55 week EMA. Deeper decline would now be seen back to 109.20 low. Overall, the down trend from 149.76 (2014 high) is not completed yet. Break of 109.20 will resume such down trend towards 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal.