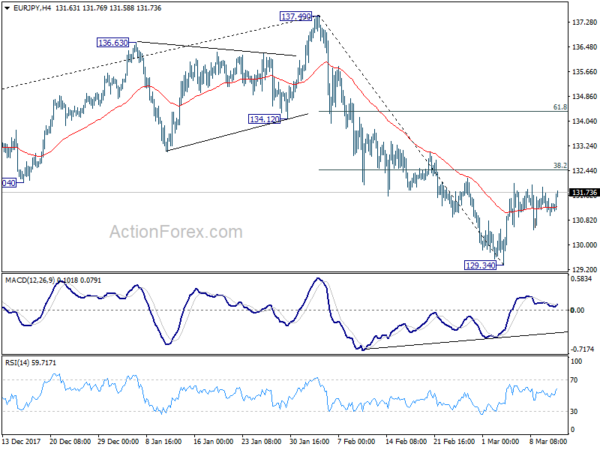

Daily Pivots: (S1) 130.91; (P) 131.30; (R1) 131.64; More….

No change in EUR/JPY’s outlook. Intraday bias stays neutral first. Corrective rise from 129.34 might extend higher. But we’d be cautious on strong resistance from 38.2% retracement of 137.49 to 129.34 at 132.45 to limit upside. Break of 129.34 will resume the whole decline from 137.49 to 126.61 medium term fibonacci level. Nonetheless, sustained break of 132.45 will target 61.8% retracement at 134.37 first, before resuming the fall from 137.49.

In the bigger picture, current development argues that rise from 109.03 (2016 low) has completed at 137.49, on bearish divergence condition in weekly MACD. Deeper fall should be seen to 38.2% retracement of 109.03 to 137.49 at 126.61 first. On the upside, break of 137.49 is needed to confirm medium term rise resumption. Otherwise, risk will now stay on the downside even in case of strong rebound.