Daily Pivots: (S1) 119.53; (P) 120.18; (R1) 120.69; More…

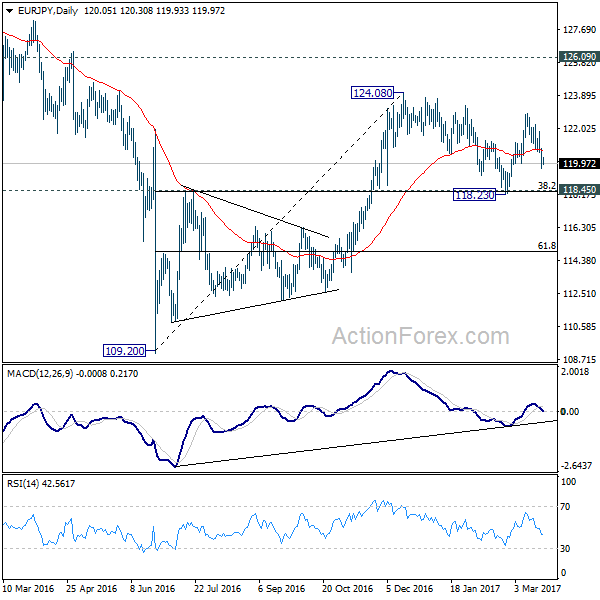

EUR/JPY’s fall from 122.88 is still in progress and intraday bias stays on the downside for the moment. With a break of 120.01 minor support, the cross should now target 118.39/45 key cluster level again (38.2% retracement of 109.20 to 124.08 at 118.39). However, as such decline is viewed as part of the consolidation pattern from 124.08, we’d expect strong support from 118.39/45 to contain downside and bring rebound. On the upside, above 120.81 minor resistance will turn bias back to the upside for 122.88 and then 124.08.

In the bigger picture, we’re holding on to the view that medium term rise from 109.20 is still in progress. Focus is on 126.09 key resistance level. Sustained break will confirm completion of the whole decline from 149.76. And rise from 109.20 is of the same degree as the fall from 149.76. In such case, further rally would be seen to 104.04 resistance and possibly above before topping. Meanwhile, rejection from 126.09, or firm break of 118.45 cluster support, will likely extend the fall from 149.76 through 109.20 low.