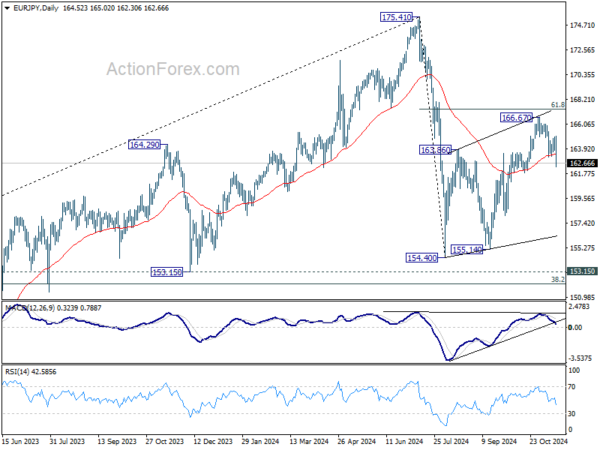

EUR/JPY’s fall from 166.67 continued last week after interim recovery. The break of 55 D EMA (now at 163.41) argues that corrective rebound from 154.40 has completed with three waves up to 166.67. That came after rejection by 61.8% retracement of 175.41 to 154.40 at 167.38. Initial bias is now on the downside this week for 155.14 support next. For now, risk will stay on the downside as long as 165.02 resistance holds, in case of recovery.

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.

In the long term picture, considering bearish divergence condition in W MACD, 175.41 is at least a medium term top. It’s still early to conclude that up trend from 94.11 (2012 low) has completed. But a medium term corrective phase is in progress with risk of deeper fall back to 55 M EMA (now at 147.33).