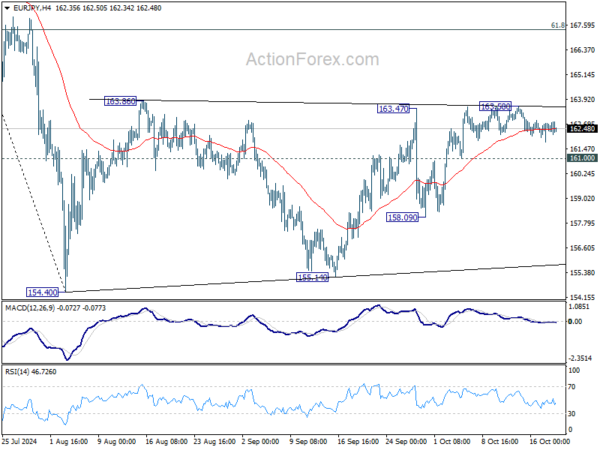

EUR/JPY edged higher last week but failed to break through 163.86 resistance. Initial bias remains neutral this week first. On the upside, firm break of 163.86 resistance will resume the rebound from 154.40 to 61.8% retracement of 175.41 to 154.40 at 167.38. On the downside, break of 161.00 minor support will turn bias back to the downside. Further break of 158.09 will target 154.40/155.14 support zone.

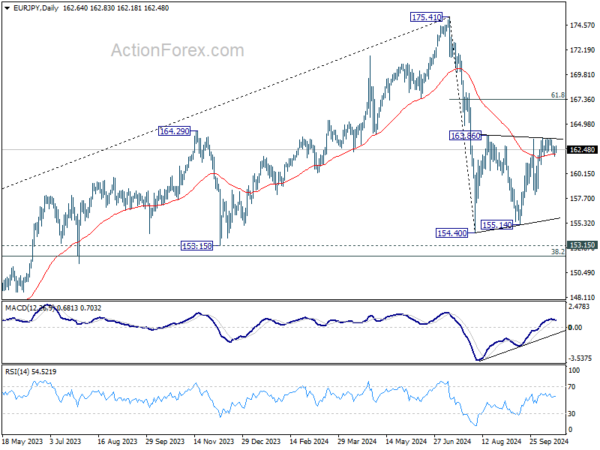

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.

In the long term picture, considering bearish divergence condition in W MACD, 175.41 is at least a medium term top. It’s still early to conclude that up trend from 94.11 (2012 low) has completed. But a medium term corrective phase is in progress with risk of deeper fall back to 55 M EMA (now at 146.64).