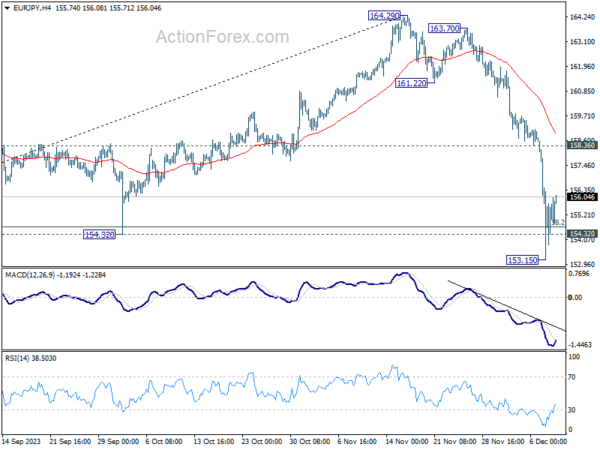

EUR/JPY’s decline from 164.29 accelerated to as low as 153.15 last week, but recovered after breaching 154.32 cluster support (38.2% retracement of 139.05 to 164.29 at 154.64). Initial bias is turned neutral this week for consolidations first. Upside of recovery should be limited below 158.36 minor resistance to bring another fall. Sustained trading below 154.32 will target 61.8% retracement at 148.69 next.

In the bigger picture, price actions from 164.29 medium term top are tentatively seen as a correction to rise from 139.05 for now. As long as 148.48 resistance turned support holds (2022 high), larger up trend from 114.42 (2020 low) could still resume through 164.29 at a later stage.

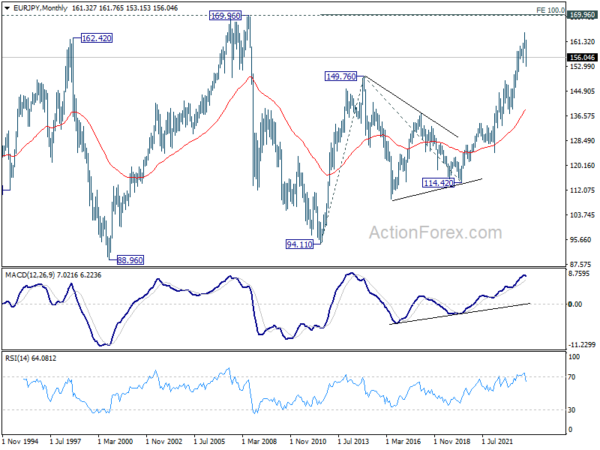

In the long term picture, rise from 109.03 (2016 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). Next target is 100% projection of 94.11 to 149.76 from 114.42 at 170.07 which is close to 169.96 (2008 high). This will remain the favored case as long as 148.48 resistance turned support holds.