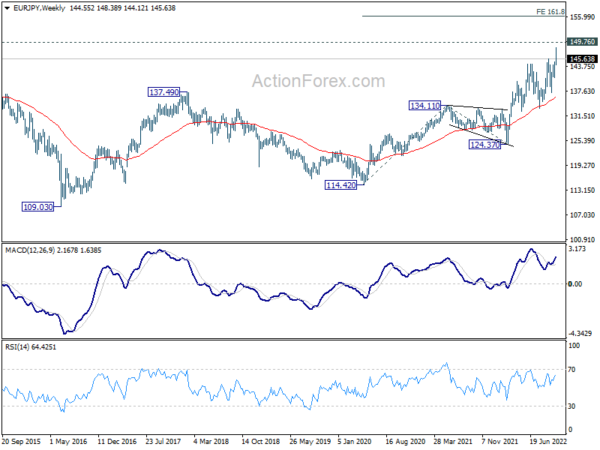

EUR/JPY’s up trend resumed last week and hit as high as 148.38. But subsequent retreats indicates that it’s turned into another consolidation phase. Initial bias is turned neutral this week first. Downside should be contained by 140.88/144.06 support zone to bring another rally. Break of 148.38 will resume larger up trend to 100% projection of 133.38 to 145.62 from 137.32 at 149.56, which is close to 149.76 long term resistance.

In the bigger picture, the up trend from 114.42 (2020 low) is still in progress for 149.76 (2014 high). Decisive break there will pave the way to 161.8% projection of 114.42 to 134.11 from 124.37 at 156.22. This will now remain the favored case as long as 137.32 support holds.

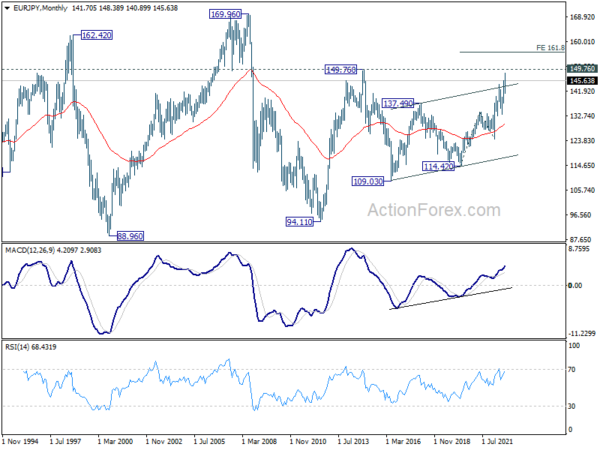

In the long term picture, there is sign of upside acceleration with strong break of long term channel resistance. Outlook will stay bullish as long as 134.11 resistance turned support holds. Sustained break of 149.76 (2014 high) will open up further rally, as resumption of the rise from 94.11 (2012 low), towards 169.96 (2008 high).