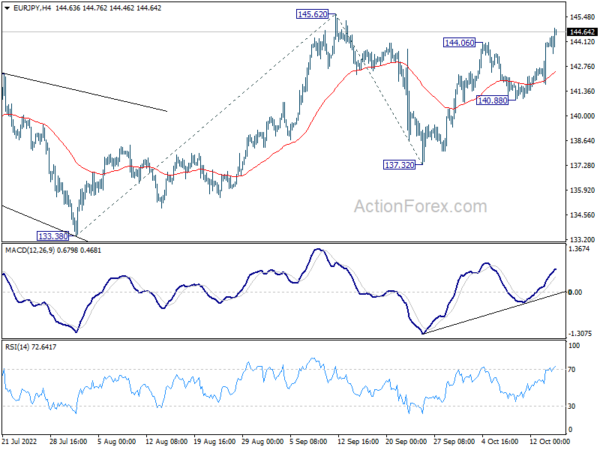

EUR/JPY’s rise from 137.32 resumed and extended higher last week. Initial bias stays on the downside this week for retesting 145.62 high first. Decisive break there will confirm up trend resumption. Next target is 100% projection of 133.38 to 145.62 from 137.32 at 149.56, which is close to 149.76 long term resistance. On the downside, break of 140.88 will extend the corrective pattern from 145.62 with another falling leg.

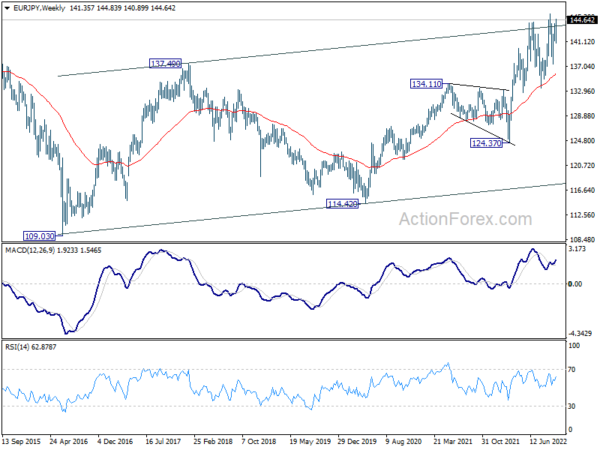

In the bigger picture, as long as 133.38 support holds, the up trend from 114.42 (2020 low) could still extend through 145.62 high. In that case, next target is 149.76 (2015 high). However, sustained break of 133.38 will be a sign of medium term bearish reversal and bring deeper fall to 124.37 support first.

In the long term picture, as long as 55 month EMA (now at 129.41) holds, up trend 109.03 (2016 low) should still extend higher to 149.76 resistance (2014 high). However, sustained break of 55 month EMA will argue that the three wave pattern has completed, and bring deeper fall back to 109.03/114.42 support zone.