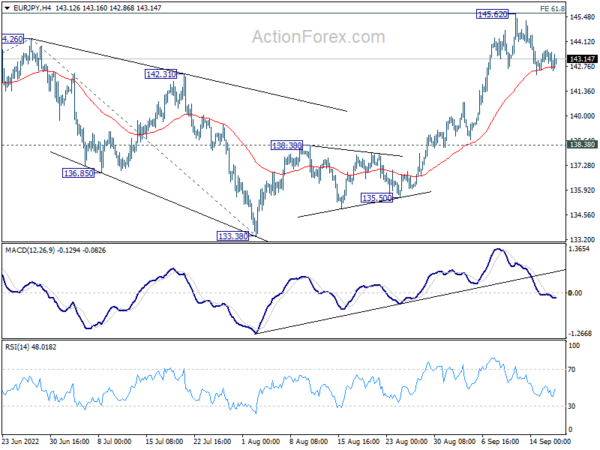

EUR/JPY’s up trend continued to 145.62 last week, just inch below 61.8% projection of 124.37 to 144.26 from 133.38 at 145.67. But the cross then turned into consolidations, and initial bias is neutral this week first. Deeper pull back cannot be ruled out. But downside should be contained above 138.38 resistance turned support bring another rally. On the upside, decisive break of 145.67 will pave the way to 149.76 long term resistance, and then 100% projection at 153.27.

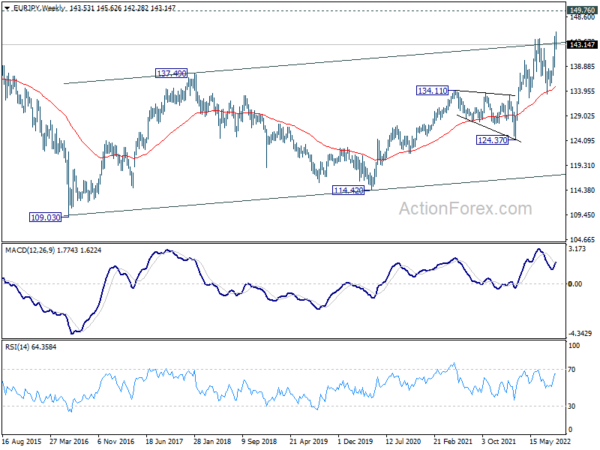

In the bigger picture, up trend from 114.42 (2020 low) is seen as the third leg of the pattern from 109.30 (2016 low). Further rally is in favor as long as 133.38 support holds. Next target is 149.76 (2015 high). However, sustained break of 133.38 will be a sign of medium term bearish reversal and turn focus to 124.37 support for confirmation.

In the long term picture, up trend from 94.11 (2012 low) is seen as in the third leg. Further rally would be seen to 149.76 resistance (2014 high) and above. This will remain the favored case as long as 55 month EMA (now at 129.46) holds.