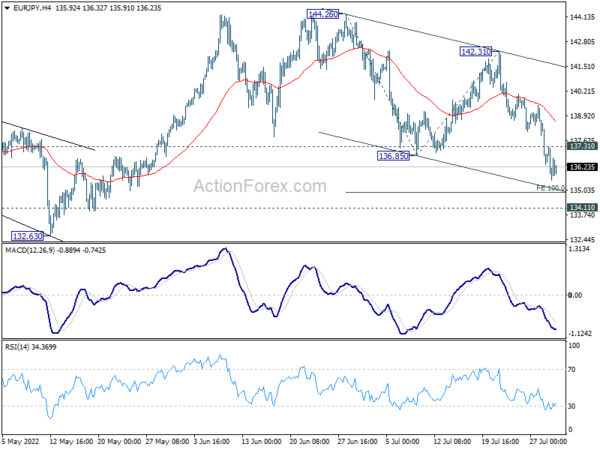

EUR/JPY’s fall form 144.26 resumed last week and hit as low as 135.53. Initial bias stays on the downside for 100% projection of 144.26 to 136.85 from 142.31 at 134.90, and possibly below. Strong support should be seen above 134.11 to complete the correction. On the upside, above 137.31 minor resistance will turn intraday bias neutral first.

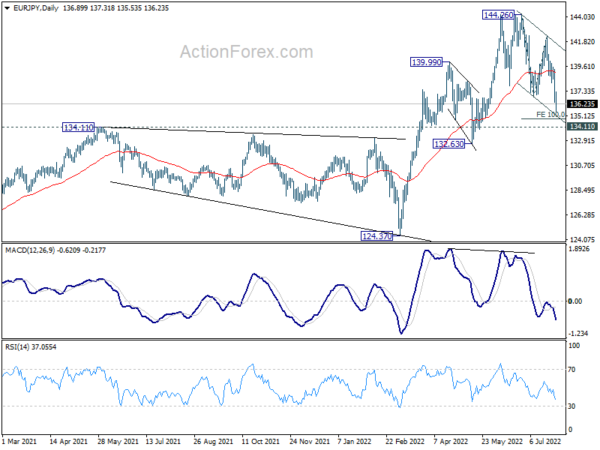

In the bigger picture, up trend from 114.42 (2020 low) is seen as the third leg of the pattern from 109.30 (2016 low). Further rally is in favor as long as 134.11 resistance turned support holds, even in case of deep pull back. Next target is 149.76 (2015 high). However, sustained break of 134.11 will be a sign of medium term bearish reversal and turn focus to 124.37 support for confirmation.

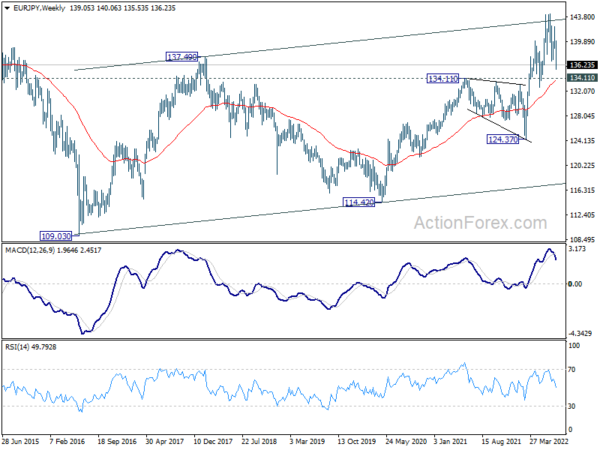

In the long term picture, up trend from 94.11 (2012 low) is seen as in the third leg. Further rally would be seen to 149.76 resistance (2014 high) and above. This will remain the favored case as long as 55 month EMA (now at 128.55) holds.